[The Weekend Bulletin] Rebooting 2023 - Links Worth Revisiting

A collection of some of good articles worth re-reading.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

👉🏼 As has been the tradition, we end the year by revisiting some of the best (in my opinion) articles that we've read through the course of the last one year. You’ll have to view this in your browser as your email client will not display the whole message due to its length.

👉🏼 Other than the division in to relevant topics, there is no order to the articles. Feel free to explore the way you deem fit. Rather than being read over a weekend or a week, this one is meant to be consumed slowly, over time. The ideal way would be to just bookmark this issue and then return to it for a deep dive into a topic that you wish to learn more about.

👉🏼 Links to previous reboots are at the end of the issue.

👋🏻 See you in the new year. 🎅🏼 Season’s greetings 🥂 and happy reading 📖👓.

Investing Wisdom

Investor Interviews/Letters/Profiles

This is a fantastic conversation covering so many first principles about life, business, trust, decision making, biases and more. You should definitely make time to listen to this one: Kunal Shah on The Knowledge Project.

By design, gross margins exist when you allow human beings to jump their social status. And gross margins disappear when you do not help them increase their social status.

One of the interesting things i always wonder about is that it's very easy to find super apps in Asia, but rarely you find super apps in a western societies. But it's also true for super stars and super companies and conglomerates. ...Every low trust society will have concentration of trust.

Using emotions to detect symptoms is great, using emotions to solve or make decisions is terrible.

One of the reasons I find this so helpful is that the sources of all our biases are blind spots. You know, we can only see through our frame of reference, but the world exists outside of our frame of reference. When you ask yourself like, what would Warren do? Or what would Steve do? Or, you know, what would Kunal do? What you're really doing is your getting out of your own head, and your seeing the world through a different lens. And that in and of itself starts to reveal blind spots. And the source of all bad decisions is blind spots.

This article reproduces a section of Seth Klarman's letter where the famed investor reminds us of the forgotten lessons of the 2008 financial crisis.

Here is a nice summary of an investing legend's biography: John Neff on Investing. Neff was a modern value investor, in that he combined valuation with business quality and didn't compromise on either. For his outstanding track record, he is not as widely known though. This article is a good starting point to get to know about him.

Pair the above with this article for a sneak-peak in to some of his investing principles.

This article traces a very interesting journey of a lesser known Chinese investor who runs a $60bn fund. Interestingly, the fund counts the Yale endowment as his first investors, and Tencent amongst its early investment.

At a 140 pages, this investor letter by Christopher Bloomstran (Semper Augustus) is the equivalent of half a book. But unlike a book that usually circles around a singular subject, this letter takes you on a few different journeys, like:

Looking at current market through the lens of an expected returns model;

Investing through inflation in the 70's;

Correlation of price to sales ratio with returns over history;

The Nifty Fifty Bubble;

Book Recommendations; and

A 70 page update on Berkshire (capital allocation, returns expectations, holdings etc).

Two Indian investors discuss their journeys and the lessons that they picked up along the way:

The Art Of Investing by Rajashekhar Iyer

(Interesting that most long term investors will espouse the benefits of buy-and-hold, but this investor talks about the importance of selling, as well as taking cash calls. A very interesting talk indeed.)

A new book that draws parallels between evolution and investing is the talk of the town in India. The author - Pulak Prasad, founder of Nalanda Capital - has kept away from the public eyes for decades. This tradition breaks with the release of his book. His public appearances are now widely circulated, and rightly so. Here are two such appearances:

An interview - his first - where he talks about the inspiration behind the book, the founding principles of his firm, as well as his investment philosophy. Watch/Read here.

An article where he pens his thoughts around the kind of signals from company managements that investors should avoid, and lists the right signals that investors should seek. Of course, he connects all this to evolution.

This podcast is such a high density conversation. Patrick O'Shaugnessy interviews Scott Davis and Rob Wertheimer who are the authors of the book Lessons from the Titans. In the book, the authors draw lessons from the success and failure of some of the industrial giants. The conversation revolves around these lessons and covers the following:

Saumil Zaveri's (DMZ Partners) letters have always made for an interesting read. We've look at a few in the past. The current one, 15th in the series, and unfortunately the last public one, makes for an equally interesting read. The following are some of the topic covered in this letter:

Spectrum of Looking Crazy to Being Crazy

Similarity between banking and investing

DMZ’s philosophy

Being patient vs being wrong

Being early vs being wrong

Valuation vs business risk

'Monitoring the situation closely'

Famed buisnessman and legendary investor Sam Zell passed away last week. A few week prior, he appeared on a podcast where he talked about his journey, what drives him, and what he values most in his life.

"What drives me is, can I do it? Can I achieve the intended? Can I do so legally and with pride, that I can sit here today and describe a transaction to you and feel very comfortable that I tested my limits, found out could I do it, and then by doing it, I've gained great satisfaction. I certainly have made more money than I could ever spend.

The money was never really the driver, other than the money creates freedom. Money creates an environment where you can do what you want to do, maybe without asking permission.

...

As a sport or as a hobby, I ride motorcycles. And when you ride a motorcycle and you feel the wind come through your helmet, you realize that you’re in total control of what you’re doing. There’s a sense of freedom that’s irreplaceable. In the same manner, having the resources to not start every conversation with can I afford it, whether I want to do it, are two very different things. There’s nothing more important to me than freedom.

...

I view money as a way of eliminating a step to achieve my objectives, but not be constrained by limitations. In the same manner, when it comes to liquidity equals value, that’s something that I coined for my own benefit, to remind me of the fact that I’m constrained only by the exterior events that occur around me. To the extent that I have a liquidity, I can make choices. And if I can make those choices, and, so without the constraints of liquidity, that is, I don’t to start by saying, well, where am I going to get the money? But I’m going to start by saying, how do I spend the money? What do I think is important? I think those are criteria that define what I call freedom."

Two business operator stories that I thoroughly enjoyed:

A deep dive in to the life, values, and principles of Brunello Cucinelli

Brunello Cucinelli was born into very humble beginnings in Castel Rigone growing up with no running water or electricity. But through dreams, hard work and determination Brunello has gone on to found and create the fashion empire brand, Brunello Cucinelli. The “king of cashmere,” Cucinelli dropped out of engineering school and used a $550 loan to launch a fashion line in 1978. He donates 20% of his profits through the Brunello Cucinelli Foundation. He has been described as a “philosopher-designer” for his approach to humanistic capital and as of today the market cap of Brunello Cucinelli is $5.2 billion euro.

Sol Price - Retail Revolutionary

Sol was a poster child for the American dream. His immigrant parents were born in a small Russian village. Sol was the first in his family to graduate college. He earned a law degree. He became an exceptionally successful businessman and philanthropist, celebrated 70 years of marriage, was a good father who instilled high values in his sons, and he never walked away from responsibility. Sol Price is the most influential retailer of all time. If you factor in how many people are on record saying that they took Sol's ideas and applied it to their own life and work: Jim Sinegal’s Costco, Sam Walton of Walmart, Jeff Bezos of Amazon, Bernie Marcus of Home Depot, the founder of Trader Joe's. It's pretty incredible to think that Sol's ideas have created literally trillions of dollars of value.

Here's a fantastic business journey: It started in the 1930's, mostly by accident. The current product was developed around the 1950's, and hasn't changed form since 1958!! The product was initially patented, but lost that protection many years back. Despite that, the business was a great international success. However, it witnessed multiple years of losses in the 90's, and was on the verge of bankruptcy. It then went through a turnaround, largely by looking inward rather than outward. Over the years, the business is not just a great turnaround story but amongst the most valuable companies in its category. Physical product, global distribution, digital presence, social media app, crowdsourcing ideas, association with franchises like star wars, batman etc, appeal to customers across age-groups - any consumer metric you name, this brand has mastered it. This is the story of the iconic Lego blocks.

I thoroughly enjoyed this interview of Chris Begg from East Coast Asset Management by William Green (Author: Richer, Wiser, Happier). This conversation dips into Chris's investment style of looking for storm clouds masking great businesses, his mental framework of how reducing entropy creates value (which is also one of the eight moats he looks for in a business), his strategy of building depth and breadth of knowledge, his exercises for the mind, body, and soul, and a few other things. A lot to take away from this conversation, like from his other interviews and writing.

Long time readers may recount having encountered a very detailed interview if Chris in #36:

Chris Begg of East Coast Asset Management is a great thinker and writer. I used to really enjoy reading his investor letters, until they stopped coming after 2015. And like his letters, this one was so really worth the time spent (and worth re-reading once in a while). In this interview, Chris outlines his investment philosophy, provides a glimpse into his investment process, along with some checks that he has built to overcome behavioural biases, and how he tackles reading for himself and his team. He ends the interview with how reading philosophy has made him a better investor - not something you hear often. Lots of wisdom in this one.

This article contrasts the investment style of Peter Lynch with most great investors. It also describes the framework that Peter used to find 10-baggers.

I happened to re-read this old interview of Peter Bernstein by Jason Zweigwhich is do dense with investment wisdom. Peter discusses common mistakes made by investors, the importance of risk management, and how to avoid being shocked by surprises that may occur in the market. What I like most was his emphasis on diversification as an aggressive strategy, and his thoughts on how consequences matter more than probabilities.

“I view diversification not only as a survival strategy but as an aggressive strategy, because the next windfall might come from a surprising place. I want to make sure I'm exposed to it. Somebody once said that if you're comfortable with everything you own, you're not diversified.”

In his latest memo, Howard Marks looks at the five market calls that he has made over the past 20 years and draws some lessons for readers. He posits that his calls worked because he made so few of them, and also because they were not based on macro forecasts. He argues that investors seeking to know the market’s likely direction should focus on taking its psychological temperatureand understanding the nature of cycles. He reiterates his long held views of understanding investor psychology and market cycles, being a contrarian at the extremes, using second order thinking, and avoiding macro forecasts.

Legendary value investor and author of 'Margin of Safety', Seth Klarman, has been elusive from the public eye. Like his out of print book, his investor letters are highly sought, but difficult to get a hand on. Recently, he made a public appearance on the Capital Allocators podcast to discuss the recently released 7th edition of Graham and Dodd’s value investing classic, Security Analysis. The conversation also covers the origins of Baupost, the investing principles that it follows, how these principles have changed or stayed the same over time, portfolio construction, risk management, research process, illiquidity and more.

In this 2006 lecture in Bruce Greenwald's class at Columbia Business School, famed investor Li Lu, delivers his investment philosophy through case studies. He explains how value investors are a small minority working in the market that is designed to work against them. He also advocates developing a journalistic streak in order to becomes a successful value investor, as well as allocating 'shit-load' of capital to an investment after having done the work. This is a mini masterclass in value investing. You can also read a crisp summary here.

Another value investor with an envious track record of managing public money - Joel Tillinghast (manager of Fidelity Low-Priced Stock, has beaten the S&P 500's 9% annual return since 1989 with an annualized total return of 13%) - lays down his thought process in this short interview.

Two private investor interviews that trace their journey in to investing, the development of their investment philosophy, and outline some of their mistakes and learnings:

John, one of the two Collison brothers that co-founded Stripe and have worked on recently releasing a new version of Poor Charlie's Almanack (including a free web-version), released a conversation he had with Charlie Munger. This free-flowing conversation covers a wide range of topics including the importance of quality, multi-disciplinary learning, challenges in investing, art and architecture, "win-win" business, his partnership with Buffet, unique aspects of Berkshire to name a few. My favorite part of the conversation was when Charlie, in his unique style, offered advice to cope with difficulties [emphasis added]:

[00:36:35]: "I have one standard set of advice for all difficulties, suck it in and cope. That's all any human being can do, SUCK IT IN AND COPE."

The CIO of the largest mutual-fund in India, R Srinivasan, opens up about the secrets of his long standing track-record of beating the markets. He reflects not only about on ingredients of his success but also recollects some of the mistakes made along the way and the lessons learnt. He explains his core and satellite approach to portfolio construction, criteria for identifying good businesses, and the challenges of combining good business, management, and price in investing.

'Cracking the Multibagger Code' - that's the title of the final talk for this week. Money Manager Siddhartha Bhaiya presents his learnings from investing in multibagger stocks in this talk to CFA society members.

Business Characteristics / Moats

Culture is often quoted as one of the competitive advantages that help businesses not only survive but strive over time. But culture is a soft skill and difficult to quantify. This article attempts to list some common traits observed in well cultured companies.

Growth of one of the most celebrated fundamental attributes. Everything else being the same, higher growth is always rewarded by investors with higher multiples. However, there is one industry where high growth is not necessarily a good thing, claims this article. The authors go on to show empirical evidence of how high growth has destroyed value eventually in this sector. This is a highly under-appreciated nuance.

We've all heard of how seemingly ‘boring’ businesses often deliver the best returns. Here is one such: a uniform rental business that 'delivered sales growth of 23% a year for 35 years while profits grew at a staggering 30% per annum. In fact, a $100 investment in Cintas Corporation back in 1984 would be worth nearly $60,000 today, a return that dwarfs the $4,200 return from the S&P500 and even surpasses the $16,800 return from Warren Buffett's Berkshire Hathaway.' This article captures the key factors behind the success of this business from a book written by the man at it's helm for over 50 years.

This old article resurfaced on the back of a recent discussion. In it, the author explains the idea of 'capacity to suffer', a concept popularised by famed investor Thomas Russo. This is an important characteristic that both, the investor and the investee, need to demonstrate for long term success. The author also provides a few ways in which companies demonstrate this capacity to suffer.

Michael Mauboussin refreshes his earlier work on the relationship between return on invested capital and total shareholder returns in this paper. It starts by providing the latest ROIC figures, then examines the link between persistence or changes in ROICs and total shareholder returns (TSRs), and finishes by reviewing elements of competitive strategy as well as persistence of ROIC by sector.

Extending the argument against 'buy and hold', one of the other issues with this maxim is that very few companies (~4%) are able to hold on to their moats over extended time horizons. What you buy today may have a strong competitive advantage, but it may diminish over time. While competition is one reason why moats erode, it is not the only. There are many factors intrinsic to an organisation due to which it's competitive advantage may die, as this post explains.

This article makes an important point about small companies - their biggest moat is their management. However, the key to understand here is that the founder or management that runs the business at a certain scale may not be the best choice to run it at a larger scale. The article explains why and provides some hints to identify managements that can really scale small businesses.

The author of this post argues that the term is moat is misunderstood, and used loosely. He discusses the concept of moat, and outlines three questions that need to be answered when talking about moats. He also emphasises on the importance of identifying the key metrics the measure a moat, as it is direction, rather than the moat itself, that defines future returns.

While quite a lot has been written about operational efficiency and market strategy, not as much is printed about capital allocation. Indeed, many investors have spoken about the need for a good capital allocation policy. However, not much has been said about the same from a business perspective - what exactly is a good capital allocation policy? The following series of articles attempt to answer that question from a business operator's perspective by looking at some real life examples:

Dell's Capital Expertise: A look at how Michael Dell used capital to his advantage at various stages of growth in Dell's journey and how those decision defined the future of Dell.

The Skill of Capital: This article looks at how different businesses have used different forms of capital to create a long growth runway and a sustainable competitive advantage.

Lee Walker and the Dell Growth Plateau: This article goes back to the example of Dell. This time it demonstrate how a business operator has to balance all the three core areas spoke of above. Beyond the obvious, the article also shows how a long term business success is overcoming a series of hurdles rather than one giant leap. It also shows the role the luck and constraints play in long term success.

The Capital Cycle: This article looks at the concept of 'capital cycle' as popularised by the book Capital Returns and how both investors and business operators can take advantage of this cycle.

[This is a 5 part series, however, one of the instalments is behind a paywall, and hence have linked on four.]

The latest paper from Michael Mauboussin and Dan Callahan covers a very important and interesting topic - Corporate Life Cycle. Traditional theory has used the age of the business and its growth rates to categorise a business in to different life-cycle stages like Growth, Maturity, Decline etc. However, the authors of this article (quoting work from other researchers) argue that a better way to do this is to look at ROIC and cash flows rather than sales growth or profitability alone. The paper goes on to explain why so, backs it up with data, and then presents data on the how the companies transition between various stages, and the historical shareholder returns that have been generated through such transitions (or avoiding them). They also present a list of relevant considerations for the various stages. This makes for a very good read.

Pricing power has been called the single most important business attribute by many great investors including Warren Buffet and Charlie Munger. This article is a deep dive on this subject. The author argues that pricing is as much about psychology as about competitive dynamics - one of the reasons that companies operating in competitive markets such as yoga pants or plastic shoes for children are able to raise prices. The author further lists multiple stratgies that companies can use to raise prices without much pushback from customers.

Assessing management quality is an important part of the research process. The strength of a good management may be reflected in a number of independent factors. On the other hand, the weakness of a bad management may be reflected in a few, easily identifiable factors, according to this article. Therefore, management quality is better assessed as a process of elimination - list the negative attributes and confirm their absence. To make this task easier, the author lists a number of common signs of a bad management that have historically been observed in business that eventually went down.

Market Lessons/Cycles

If you’re hard-working, intelligent and good at exams you can become a fund manager. But that won’t make you a great fund manager, claims this post. Read on to find out what differentiates excellent from competent.

This article discusses the importance of surviving market inflection points, which are periods of rapid change in the stock market. It outlines the journey of investor John Neff to emphasise the importance of building resilience as well as staying disciplined in the wake of underperformance during such periods. A number of investors would have had similar experience over the last couple of years.

This article makes an interesting observation: a consistent way to make small amounts of money is to bet on everything returning to their “base rate”, but often the path to real alpha is to identify an “inflection” where something has changed and the base rates no longer apply. The author gives examples from the auto and cable industries, where changes in technology and market conditions led to significant inflections. The article also highlights Warren Buffett's successful investments in railroads and airlines, which were similarly based on recognizing inflections in those industries.

The author of this article recounts the many scars that one suffers on the metaphorical battle-ground of investing. These battle scars often self-inflected and hence inescapable. While you cannot avoid them, the author suggests a few remedies that can help you overcome these scars.

The author of this article argues that contrarians are usually wrong. He claims that the book/movie The Big Short has lost investors more money than the last three bear markets combined. It reminded of a Peter Lynch quote:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

The following two posts explain portions of the above quotes as they apply to life in general:

In a recent talk, Graham Weaver explores the concept of asymmetry. He starts with how his investment philosophy was initially aligned with Warren Buffet's two rules quoted above. However, over time, he came to realise that there is a better way to invest - by seek asymmetry. He then goes on to explain how seek asymmetry works not just in investing but in life as well, and lists four principles through which we can achieve the same.

Morgan Housel explains how cyclicality is all-pervasive, in this article. He explores the impact of cyclicality at different levels, including the economy, companies, and individuals. He further explains that these cycles are more often self-induced, not requiring any outside stimuli to reverse. While most of these cycles are inescapable, there are some that can managed around the edges.

This case study of an investing mistake provides some interesting insights. First, it shows why investing is simple, but not easy. Second, it shows how mistakes are unavoidable in this game. Third, it provides some lessons in how the cost of failure can be managed through position sizing. Lastly, it demonstrates how sometimes long term investors overstay a position in the hope of things eventually working out (the current price reflects the problem, but under-appreciates the business). I am reminded of a quote by Fancois Rochon here:

"Our bias toward buying and holding has at times made us too quick to rationalize a problem that hits one of our companies as temporary and “already priced into the stock.” If the problem turns out to be more long-term and fundamental, it’s likely not fully discounted into the current price at all. We’ve been blind at times to fundamental changes in a company’s business because we think the quick 25-30% drop in the share price makes the stock too cheap to sell."

Valuations, Margin of Safety

In the wake of the recent troubles at some of the banks in the US, Prof. Aswath Damodaran writes a primer on valuing banks, covering topics likewhy FCFE is not the right metric to look at banks, how he was wrong to advocate the dividend discount models for banks post 2008, what he currently thinks is the right framework to value banks, and why valuations of banks, in general, have come off (and rightly so).

Portfolio Construction

This article presents the results of an interesting experiment: 'What if instead of owning a stock-market index that is periodically reconstituted, an investor simply bought and retained a basket of equities? No new position would be established. The portfolio would change only when its companies were acquired, but even that would not trigger a trade. The purchase price would remain as cash.' How much better/worse returns would this strategy have generated compared to an index that is rebalanced frequently? Bear in mind the in the last decade, a large part of the index returns were generated by a handful of stocks (FAAMG), which never made it to the buy and hold portfolio (since no new positions were added).

Long time readers of this bulletin would recollect reading about the Voya Corporate Leaders Trust in the seventh issue.

An article took me back to this slightly dated series of post on a subject that is not often spoken about: Position Sizing. Through a series of seven short articles, the authors distill their process of arriving at and managing the weights of their holdings in the portfolio. I have seldom come across a better quantification of such a qualitative subject.

This essay tackles a less spoken and difficult topic in investing - selling. It explains why selling is such a hard activity to undertake. The essay dissects the three most common reasons for selling quoted by most investors to explain the impediments in implementing them. It also provides some ways to avoid the behavioural pitfalls that come in the way of implementing the reasons to sell.

Investment Philosophy/Horizon/Strategy

This long post makes a distinction between stress and anxiety, and posits that the long term returns in equity comes not from volatility, but from investors managing their anxiety successfully.

This two part series is a refreshing read on the interplay of value and growth, and how each effects stock returns and the investor's time horizon.

In Part 1 of the series, the author reiterates Warren Buffet's remark that growth and value are two sides of the same coin, rather than two different strategies as investors usually perceive them. By understanding the interplay between these two factors, investors can make smart decisions that lead to long-term success. One way to think about this balance is through the lens of the Gordon growth model, as the article explains.

In Part 2, the author goes on to show how an investor's time horizon is determined by the contribution of growth or valuation in the return equation. He uses Buffett's investment in the Coca Cola to explain this. The appendix to the post explains further how time works against a value investment, and in favour of a growth investment.

'Growth is not the same as Growth', claims this article. While value is represented by many variables, the definition of value is constant. Growth, on the other hand, has more than one definitions. And depending on how you define 'growth', your portfolio constituents and performance will differ meaningfully. The practitioner's growth definition is what Warren Buffett was referring to when he said that all investing is value investing

This short note looks at some past studies contrasting value and quality investing, and finds a number of similarities between the two strategies. It also highlights how the two differ, and why it makes sense to have an exposure to both in an investment portfolio.

Some simple yet profound investing truths reiterated in this well written piece by a practitioner as he looks back at investing through the pandemic. Current market conditions may be a good time to be reminded of these tenets.

I really enjoy reading stories about people who without any background in investing manage to amass wealth through a simple system over many years. Here is one such short story of a musician (Clarinetist) who used a middle class income to build a fortune in the stock market. Stories like these are a personification of the first half of the earlier referred quote: 'Investing is Simple, But Not Easy'.

The importance of a long investment horizon cannot be emphasized enough. Here is a real life example of how one lady made over $7mn by investing only $180. Compounding works wonders when you give it enough time.

Here is a nice compilation of the seven virtues that define great investors. The article lists the virtues and provides links for further reading on each virtue.

The above article reminded me of this old note from James Montier of GMO that has served as a very good re-read over the years: The Seven Immutable Laws of Investing.

Ian Cassel provides a very interesting perspective on microcap investing in this post. He contrasts between 'coffee-can investing' and what he calls 'conviction investing', and argues that most microcap investing is conviction investing. Likewise, most great investors are conviction investors.

"You have to go on a lot of dates before you find your spouse. You have to kiss a lot of frogs to find a prince. You have to turn over a lot of rocks to find a great one."

'Investing is simple, but not easy'. It's not easy, because simplicity requires an incredible amount of hard work to accomplish and the knowledge to appreciate it. Take the usual investing advice of 'buy and hold'. While a very simple tenet at first glance, there is a lot of complexity underneath - what to buy, how much to buy, how long to hold for, what kind of developments to be ignored etc. This article argues that because these investment maxims are simple, the nuance is often overlooked. Not only are they misunderstood but they are also mistaken to be a one-size-fits-all solution to the stock market. What might be perfectly good advice to one, is not applicable to another.

What makes great investors great - apart from their investing skills - is their ability to survive downfalls. All investing is fraught with mistakes, no matter how great you are. How you deal with the mistake determines not only how you come out on the other side, but your long term success. This article (part paid) explains.

This article posits that becoming an excellent investor does not require off-the-charts intelligence or some highly proprietary model that leads to an edge that nobody else can replicate. Rather, certain traits and behaviors have allowed investors to excel over the long-term. It list five traits that really differentiate the best from the rest.

This short article details an interesting quantitative screening strategy for small cap stocks. The strategy is based on James O’Shaugnessy’s Tiny Titans screening model, which he has outlined in his books. The reason it is interesting is that the model has delivered annual gains since inception of 24% vs 7.5% for the S&P Smallcap 600 index, as of July 31.

Curious about the use of AI in fundamental research, the author of this postused ChatGPT to carry out fundamental analysis of a company. The article details how the author carried out the analysis, the prompts that he used, and the responses that he received. It then summarises all that AI is good at currently, as well as it's shortcoming. Finally, it concludes with some time-saving use cases of AI in researching on a company.

Banking is an interesting sector. While it sits at the centre of all economic activities, the high leverage with which banks operate has kept many long-term investors away from the sector. Additionally, the sector has been a severe under-performer in the US over the last 10-15 years, leading to below par long term returns as well. In that context, this short note seeks to identify the factors that winners within the sector exhibited. While it does find a combination of factors that help find long term winners in the sector, the note also reflects the complex nature of banking operations, showing that the same factors may not work all the time.

This article discusses one of the last remaining edges of investors today. The author presents data on how majority of people would rather hurt themselves than sit alone with their thoughts. The author claims that investors who can do the opposite - sit still and do nothing - have an advantage. He also lists three things that the best investors do to avoid the boredom of doing nothing.

Investing is a realm where contradictory ideas co-exist. An investor is expected to maintain a fine balance while holding two opposing ideas in her mind at the same time. Below are two such ideas:

This article deals with the two sides of conviction - one of the most important elements in investing. It contrasts conviction with arrogance, even as investing demands humility as the markets are supreme. It also quotes the story of an investor whose conviction was tested when Warren Buffet dismissed his idea. What would you have done if this investor was you?

The benefits of diversification have been known for over half a century. This article therefore discusses the practical difficulties of diversification and its downsides. The author shares personal experience with diversification and illustrates what to expect in a diversified portfolio.

Risk / Regret Minimisation

A good post detailing how Steve Waugh dealt with a failure, and how some of his lessons can be applied to investing. Cant skip this if you are a cricket fan.

Two interesting write ups on the regret minimisation framework:

Mistakes can hamper our risk taking ability. Fear of continued failure paralyses us into inaction. But these are the exact moments when we need to spring into action. (Think of a sports person going through a bad patch - should they just hang up their boots, or simply play more?) This article narrates a few ways in which living beings overcome fear - for good and bad outcomes - and ends with a framework that investors can use to overcome fear induced anxiety.

While on the topic of mistakes and fear, pair the above with this articlewhich is a collection of thoughts of various investors on making mistakesand overcoming them.

In this very well worded article, the author argues that risk is what you don't see coming. It manifests as small mis-steps first which usually domino into something larger. Therefore, investing success comes not from focusing on the upside, but realising the downside potential as early as possible.

This is a part-spiritual, part-philosophical take on mistakes, including why we should not be afraid of making them, why being shameful of making this is good, and how we can learn from them: What Have You Learned?

In this next piece, the author discusses the difficulty of learning the right lessons from investing mistakes. He warns against drawing the wrong conclusions and setting arbitrary rules for oneself based on past performance, and encourages investors to be wary of dismissing entire areas of the market just because they haven't worked in the past. The author discusses the difficulty of learning the right lessons from investing mistakes: On Learning The Right Lessons

Mental Models & Behavioral Biases

Decision Making

This article recounts a game from the 2021 World Chess Championship to highlight the importance of temperament during pressure. You could be one the most gifted players in the world, however, if you can't make rational choices under pressure, you will end up with sub-par results. This applies to investing as much as it applies to sports, as the author demonstrates.

Whether it is life or business, the 80-20 principle applies. Looking back, a few good decisions would have driven the majority of outcomes (good/bad) in life, business, and investing. However, we make plenty of choices daily. How do we differentiate between the ones that matter, and the ones that don't. This article provides the answer, which might be surprising.

Two posts that look at the impact of decision making on portfolio performance:

This post looks at the impact of active portfolio management over a ten year period. It takes the holdings of all active funds and creates a buy-and-hold portfolio to compare performance. The study throws out two lessons.

This short note contests that conducting a post-mortem on decisions that haven't worked out is the incorrect way of reviewing.

When people's guesses are sufficiently diverse and independent, averaging their judgments increases accuracy by canceling out errors across individuals, resulting in the "wisdom of crowds." The same principles apply when multiple estimates from a single person are averaged, known as the "wisdom of the inner crowd", claims this article. It also defines the conditions under which this works, mindsets that can be used to improve the results, and situations in which it doesn't work.

This blog post does a very neat job of tackling the subject of errors. The author explains how the two types of errors - omission and commission are actually joined at the hip, and how minimising on can lead to an increase in the other. The author looks at the examples of Amazon and Warren Buffett to explain this.

Drawing from the recently released book "What I Learned About Investing from Darwin" by Pulak Prasad, the author of this article discusses the the two types of errors in investing and shows why its more important to not lose money than to not miss out on ideas. Most of us are so focused on the upside that we often forget about the downside.

We are constantly faced with choices in the age of abundance, which can be overwhelming. Trivial decisions, such as what to eat for dinner, consume a large amount of our daily time. Most of these everyday choices are between similar things, yet we spend the most time on the decisions that matter least. To manage the myriad decisions of the modern age, the author of this article recommends employing "philosophical razors," which shave away options and simplify choices. The article provides five heuristics to help people make quicker decisions.

Luck vs Skill

We've often read on the big role that luck plays in most outcomes in life. While we cannot change our luck completely, we can surely improve the chances in our favor - on the lines of opportunity meets preparation. Here are a few ways in which you can do that.

[Regular readers will be reminded of the long thread, and subsequent expansion into blogs, of Naval Ravikant's meditation on this subject that we have looked at in the past.

While you are at it, also read this post from where all the above originated]

This article makes an interesting proposition: force yourself to believe that luck isn't real. The author claims that doing so will make you more responsible and open to learning from mistakes.

Behaviour Biases

This short article claims that we have learnt the wrong lesson from the classic Hare and The Tortoise fable. Slow and steady wins the race under certain circumstances only.

It is a natural human tendency to seek out patterns and meaning in our environment. This ability has played a big part in our evolution, helping us make many a scientific discoveries. However, a downside of this is that we often draw patterns where none exist, a phenomenon known as Apophenia that is the basis for many superstitions and conspiracy theories. This has implications for how we behave in the markets as well. This article explains.

Picking up from Daniel Kahneman's 'Thinking Fast and Slow', this articleshowcases the strengths and weaknesses of our thinking systems, highlights the pitfalls of using only one or the wrong one, and explains why a combination of the two works best for us. A good simplification of the key ideas from the book.

The hunter becomes the hunted, or so the old saying goes. Often, what we think we possess, in reality, possesses us. The things we value may not really be as valuable. For instance, what conventional wisdom considers as the agricultural 'revolution' - the domestication of wheat - may actually be the downfall of all of mankind. Let this post explain.

Induced Demand, Jevon's paradox, and Parkinson's Law - Three mental models explained in this article that together allay a recurring fear: Starting with the industrial revolution: will machines replace humans; progressing to the technological revolution: will computers replace humans; and now reaching to the software revolution: will artificial intelligence replace humans. It's intriguing how much the answer has remained the same, and how ignorant we are to the lessons from history.

This article looks at the stats of a living sports legend to drive the point that losing is a part of winning. It reflects on the idea of losing or making mistakes in various aspects of life, including sports, investing, and decision-making.

This article makes an interesting distinction between rationality and intelligence. It quotes a few studies that have not only shown that the two are different, but also that there could be an inverse correlation between the two. The author claims that rationality is not about intelligence but about character, and lists two character traits that one should seek in order to be more rational.

We've usually read about the benefits of small incremental changes - the power of compounding small benefits over long periods of time. While that has its own benefits, there are times when you need to think radically different, rather than in increments, as per this article. Using examples of corporate success and failures, the author argues that companies should think about 10x improvements rather than marginal 10% improvements.

Personal Development

Time Management / Productivity

The abundance of information and the distraction from notifications makes it hard to stay focused and productive. Today, more than ever, there is a need for a system to manage our days, and to stay focused on what matters. Without such a system, the time just passes, the days just blur, and we find ourselves running around like a headless chicken. While a lot has been written on this subject, this series of emails is amongst the few very detailed explanations of how to plan, manage, and review your daily, weekly, and longer affairs.

I chanced upon this write-up courtesy of Sean Delaney. The author studied the childhood of many famous personalities to dig into some common traits in their upbringing. And indeed, he did find a few common patterns in the way that these exceptional people were raised. If you are a parent yourself, you shouldn't skip this one.

Paying attention is a negative skill about what one willfully ignores, more than what one actively seeks, as per this article. Choosing what to pay attention to is hard, but the best strategy is the idea of a wide funnel and tight filter. Determine what information is permanent and valuable for long-term thinking. Read on to find out more.

There is work that happens when we are working, and there is work that happens when we are not working, at least not consciously. This post highlights the power of the subconscious mind. It encourages individuals to find ways to creatively engage with their minds aside from the typical grind of daily work. The author advocates taking time away from distractions and allowing your unconventional unconscious mind to work. The author also lists a few interesting practices that can help leverage the power of the subconscious to enhance creativity, produce answers to problems, and get unstuck.

This tweet is a beautiful rumination on what makes us feel so busy, stressed, and anxious. The idea of looking at connections, possessions, and desires through the lens of surface area is an interesting way to think.

On a related note, this article by the author expands on the idea about based on a book.

The irony of our perspective on time is quite interesting - on the one hand we believe that time is abundant, while on the other we constantly complain about how we dont have enough time. The subject of time management and our struggle with it is as old as history itself (Seneca's On The Shortness of Life being the most famous, written more than 2000 years ago, definitely not our first meditation on the subject). However, the speaker of this Ted talkbelieves that modern problems need a modern solution. While all of time management talks about avoiding distractions, it may be difficult to do so in today's age given how integral smartphones are in our lives. He offers some unique solutions like managing people, rather than managing time, ruling social media rather than avoiding it, rewarding oneself, and embracing failure.

Here an interesting hack to tackle distractions. It takes the benefits of journalling and combines it with the anthropologist's practice of taking field-notes to record, observe, and analyse the root cause of distractions. Its a simple practice that can potentially unlock huge productivity or creative gains.

Knowledge Management / Learning / Personal Growth

A podcast that deals with many softer aspects of personal development. Whether you are a business owner, a team manager, or a solo-preneur, there is something that you can take away from this podcast. It deals with a range of topics from overcoming fear, to laying off people, to why companies should be lean, to how to manage your time and energy better. The speaker is a life coach having worked with many interesting founders, including Naval Ravikant. Better still, the podcast comes with a detailed document of a step by step process of everything that is being spoken about and more.

When you start a new activity, or do it for a long enough time, you often operate without any framework in mind. Take reading books for example. When you start, you have no idea what to read or how to read. For most (not all) who have been reading for a very long time, the process is so sub-conscious that they forget the essentials like arranging and maintaining their notes and highlights. For those of you who agree, here is a three-gear framework for learning that you can adopt for most activities in life.

It is said that necessity is the mother of all inventions. While that may be an over-simplification, it is not far fetched. We often perceive failure as roadblocks, giving up on valuable pursuits. However, as this article shows, persisting with failure (along with the blessings of good luck), is how innovation happens. It lists seven practical and insightful lessons about innovation, drawing from the life of someone who changed the sport of high jump forever.

This story was earlier recounted to draw some investing lessons here.

How to Work Hard - If I told you that is the title of this essay, you'd dismiss it as another one of those phoney self-help kind of catchy titles. However, this essay is a deep meditation on the subject of working hard. It looks at the problem from multiple perspectives; the below extract from the essay provides a glimpse of the many perspectives that it touches upon:

"Working hard is not just a dial you turn up to 11. It's a complicated, dynamic system that has to be tuned just right at each point. You have to understand the shape of real work, see clearly what kind you're best suited for, aim as close to the true core of it as you can, accurately judge at each moment both what you're capable of and how you're doing, and put in as many hours each day as you can without harming the quality of the result."

Here is a deep meditation in to the subject of doing great work by one of the finest modern thinkers and writers, Paul Graham. He posits that there are four steps involved in identifying and doing great work, and then peels the layers off of each step. Not only is this one a long read, but also very dense. You'll probably have to go over a few times to completely grasp all the ideas.

Paul Graham pens yet another thoughtful article. This one, titled Superlinear Returns, argues that the general wisdom of 'you get out what you put in' is incorrect. In many facets of life, especially in business and investing, returns are superlinear. He goes on to outline the two main sources of such returns, some general rules for finding situations with superlinear returns, and why the current era of technology development is one of the best times to be chasing such returns.

Everyone likes to set big goals, but very few are able to achieve them. Why does this happen? Outside of idiosyncratic factors like skill, talent, motivation, etc, there is a common reason for this gap between strategy and execution: the daily grind. More often than not, it is the day to day business that crowds out action on strategic initiatives. Author Chris McChesney, Sean Covey, and Jim Huling offered a framework in thier book "The Four Disciplines of Execution" to overcome this whirlwind of day to day work, and to create space from strategic initiatives. This article provides a good summary of the framework discussed in the book.

The second discipline in the above framework talks about leading and lagging measures. Taking this thought ahead is this article by Ryan Holiday which claims that success and failure are lagging indicators in most areas of life. So are inspiration, muses, writer's block, and the likes. In order to be achieve or overcome these, one needs to focus on the leading indicators, or the inputs.

This article describes how Richard Feynman, a brilliant scientist, used a method called "favorite problems" to achieve his impressive reputation. Feynman kept a list of a dozen open questions that fascinated him and returned to them frequently in his research. Whenever he learned something new, he would test it against his favorite problems to see if it could help him make progress. The author encourages readers to create their own lists of favorite problems to change their mindset and see endless problems as opportunities for growth.

Sam Altman, the current CEO of OpenAI (ChatGPT, Dall-E), has observed many a successes and failures in the startup world by being an entrepreneur himself (from the age of 19) as well as the president of Y-combinator. In a short blog post, he distills his years of experience in to 13 key observationsthat he believes would help anyone to achieve outlier success.

This short ted talk provides a neuroscience backed strategy to enhance you cognitive abilities. The speakers outlines 6 key ingredients that can help you improve your learning as well as retention. You'd have read about most of these six ingredients individually; this talk puts them all together.

'Your brain is a phenomenal tool. [It} will find whatever it is that you are looking for', claims the author of this article. In some ways, his words reflect the idea of Growth vs Fixed Mindset popularised by Carol Dweck in her book Mindset. The human brain is known to exhibit neuroplasticity - the ability to change through growth and reorganisation of the neural networks. But how is that we can do this? The article provides some practical insights on upgrading cognitive function by highlighting seven habits to eliminate. It discusses how certain common behaviors can hinder mental performance and offers actionable advice on what to avoid.

Feelings - Happiness, Misery, Stress etc

This article draws an interesting leaf from Ben Graham’s life to impart a very valuable life lesson.

Happiness is short lived, and follows the law of diminishing marginal utility. It is usually at its peak when we transition between two contrasting states (like have and have not), while it starts to wane as the change becomes more incremental (like having a little more). This article explains how and why, and suggests an antidote.

This articles talks about three neurochemicals that impact our productivity, both, positively and negatively. To make it easy to understand, the author simplifies how each of these relates to one of fun, fear, and focus, and how combining the three in the right amount can lead to increased productivity.

Much like how we can measure money in terms of wealth or richness (which we read about in #157 recently, and in #85 as highlighted below), we can qualify happiness into joy or pleasure. This two minute speech is the ultimate simplification of the difference between pleasure and joy. Understanding this framework can help you aim for the right metric.

Everyone experiences ruts: periods of time where they feel like they're not getting enough done, they don't feel like what they're doing is meaningful, they don't like who they are and they're living the same day, day in and day out. But since everyone gets into ruts, what differentiates people is how quickly they recognize they're in one, and take action to get out of it. Here is a three-step method to get out of a rut.

Interestingly, the mindset that you subscribe to (fixed vs growth) also impacts how you deal with mistakes and bounce back. This short article looks at the neuroscience behind this and explains further.

This article claims that we pay twice for all our possessions. While the first price is the monetary value that we pay, that is less important than the second price that we pay. However, since the first price is easily quantified, we pay more attention to it, while ignoring the value of the second price that we pay. The authors explains the problem and provides a simple solution to overcome the problem.

Research shows that there are eight different types of friends you need to feel fulfilled. Each of these eight individually cover different psychological needs like the need for mentor, an adventurer, a party animal, a preacher etc. This article lists the eight different types and explains why and how to find these friends.

Frederik Gieschen talks about the downside of the Marshmallow mind in this post. We are all aware of the famous Marshmallow study that concluded that kids who would resist eating a marshmallow did better later in life (although there were contrasting results discovered later). He argues that once you make delaying gratification a part of your identity, you may not be able to go back to ever enjoying the spoils - rich but unhappy. He draws up three paths - the marshmallow failure, the marshmallow trap, and the middle path to advocate for a balance of wealth and happiness.

Skill Enhancement

This short note describes a highly effective but counter-intuitive strategy to get the most out of your reading. Following this simple strategy would require that we unlearn what we have learnt in school/college. While it is tough to give up an old habit, this small tweak will lead a significant improvement in your knowledge intake.

This article explains the difference between habits, routines, and rituals. The author discusses the Intentionality Curve in the context of the three activities, and the level of consciousness required for each. Understanding these difference can help us design better lives, claims the article.

Ideation / Meditation / Stoicism

Food for thought (courtesy Anshul Khare; edited for brevity):

Life imprisonment or death penalty - Which is better?

Two friends, a banker & a young lawyer, decided to figure out — in an unconventional way

No brainstorming. No research. No interviewing people.

They put to test the ultimate learning tool having Skin in The Game.

The banker wagered all his money and the lawyer bet his life.

The deal was that if the lawyer could spend 15 years in total isolation, the rich banker would pay him all his money.

...

The condition was that the lawyer would have no direct contact with any other person. Though he was allowed to write notes to communicate with the outside world.

Confined to a room, loneliness and depression ensue for the lawyer.

But he didn't want to feel like a victim.

He took advantage of the solitude and started reading. As years passed, the lawyer immersed himself in books from all corners of the world.

The more he read the more he wanted to read.

This flipped the game.

Completing 15 years would make him a very rich and WISE man.

As men become wiser, how they look at the world changes, and so do their plans.

Just a few hours before the 15 years period was about to expire, the lawyer forfeits the bet and runs away.

In his note to the banker he reasons that the wisdom he gained in those 15 years solitude, reading & reflection was far more than what the banker could ever pay him.

Banker's real gift to the lawyer was the gift of solitude.

But modern man avoids the solitude like a bubonic plague.

We have such low tolerance for loneliness that we allow any crap — soul-sapping work, toxic entertainment, hideous people — to encroach our time.

This Banker-Lawyer anecdote is inspired by Russian writer Anton Checkov's short story "The Bet" which he wrote in 1889.

So many influential thinkers from the past have vouched for the productivity of solitude that it's almost like a rule -> solitude = productivity

Mahatma Gandhi wrote:

"After 1894 all the time for sustained reading I got was in jails of South Africa. I had developed not only a taste for reading but for completing my knowledge of Sanskrit and studying Tamil, Hindi and Urdu...The South African jails had whetted my appetite and ... I was grieved when during my last incarceration in South Africa I was prematurely discharged."

Source: MK Gandhi, My Jail Experiences - X1, Young India 4th Sept. 1924

Even Jawahar Lal Nehru's famous book "Discovery of India" was mostly written when he was serving time in jail as political prisoner.

And if you've not read Jail Diary of Bhagat Singh then ... you don't know what you're missing out on.

The involuntary confinement to home during Covid-19 presented one such opportunity to me. I immersed my self in intense learning and reflection.

“Any year that you don't destroy one of your best-loved ideas is probably a wasted year.”

~ Charlie Munger.

2020 became that year of destruction for me. I saw my most cherished and long held beliefs, about the external as well the internal world, getting demolished.

It's not that I came out with renewed energy & 10x productivity to do my work.

What I defined as "as work" changed

In fact, everything changed — the work I do, the food I eat, the people I hangout with, the books I read, the movies I watch, the things I talk to my kids about

That's the transformative power of loneliness.

I hope you'll give that gift to yourself.

Here is a different but interesting podcast. It looks at the journey of two wildly successful creators - Pablo Picasso and Walt Disney - and contrasts the value systems of the two. While each was gifted in his own way, its interesting how different their attitudes were to the external world. This is an important lesson that we often miss - people with a few great qualities are not necessarily great role models. We should be extremely careful in choosing our heroes. A lot of geniuses were extremely gifted with one ability or quality, and terribly deficient in some other. The following quote summarises this well:

“Recognize what you like about somebody. Admire it as a quality separate from that particular person, rather than confusing it with him or her. What you admire about them are qualities that exist separately from the particular (and therefore flawed) example that they constitute.” – Darren Brown

A lot has been said and written about mindfulness as a practice. The act of positive self-talk, or journalling, is known to help overcome stress and anxiety. However, the author of this article claims that while these 'top-down' approaches work, there is a simpler 'bottom-up' solution that one can look at - an operating manual for the nervous system, of sorts. The solution lies in the regulation of the one of the most autonomous functions of the human-body: breathing. The author goes on to explain how to regulate our energy, feel more calm, and be more present, and offers two breathing techniques to help up- or down-regulate the nervous system in real-time: the "breath of calm" and "espresso breath."

This short post looks at two important principles from the Stoic Philosophy - Amor Fati and Memento Mori. These seemingly simple principles safeguard us from a number of biases like hubris, negativity, envy, wishful thinking etc.

For a more deeper understanding of these principles, including their origins, read here:

Physical Well-being

Here's an interesting fact: According to research by Unicef, among 41 developed countries, there is only one country where fewer than one in five children are overweight: Japan. This article explores why this is the case, and leaves us with an a very important message: consistency trumps intensity. It reminded me of this passage from the book Ikigai:

Studies from the Blue Zones suggest that the people who live longest are not the ones who do the most exercise but rather the ones who move the most.

When w e visited Ogimi, the Village of Longevity, we discovered that even people over eighty and ninety years old are still highly active. They don’t stay at home looking out the window or reading the newspaper. Ogimi’s residents walk a lot, do karaoke with their neighbors, get up early in the morning, and, as soon as they’ve had breakfast—or even before—head outside to weed their gardens. They don’t go to the gym or exercise intensely, but they almost never stop moving in the course of their daily routines.

...

You don’t need to go to the gym for an hour every day or run marathons. As Japanese centenarians show us, all you need is to add movement to your day.

Most of us have the capacity to make it well into our early 90’s and largely without chronic disease. This article lists some research backed activites/lifestyle adjustments that can help increase average life expectancy by 10-12 years. Resonates closely with the book Ikigai.

Personal Finance

When presented between a choice of purchasing two businesses - one with a very high profit margins but negligible cash flow generation, and the other with a very low profit margin but very high cash generation - most investors would prefer the latter. After all, it is cash flows and not profit margins that generate value in a business. A similar thought process applies to personal finance. While most people think that high income is the surest path to financial freedom, it may not always be true. A high income can make you rich, but not wealthy. This difference between rich and wealthy is one of my favourite personal finance frameworks. This article explains the difference.

Most of behavioural finance concerns with how we behave as investors. But, how we spend our money is also telling - it reveals things about people’s character and values. There is a science to spending money – how to find a bargain, how to make a budget, things like that. But there’s also an art to spending. A part that can’t be quantified and varies person to person. And this art side of spending can reveal an existential struggle of what you find valuable in life, who you want to spend time with, why you chose your career, and the kind of attention you want from other people. This posts lists a few factors that influence our spending behaviour.

This article answers the question: What's maters most when it comes to building wealth - Is it asset allocation, or investment horizon, or mindset, or something else? Read on to find out.

The financial independence and early retirement movement has gained a lot of prominence in the recent past, better known as FIRE (Financial Independence, Retire Early). Interestingly, there are multiple branches of fire, depending on the path you choose towards achieving your retirement goals - like lean fire, barista fire, and fat fireto name a few. This article explains what each of these different types of FIREs mean, and then digs deeper into the FAT FIRE, which is retirement without a compromise on lifestyle.

One of the important considerations is personal finance is how much can an individual withdraw from her corpus after retirement. The withdrawal rate determines the tenure for which the funds will support the retiree and therefore one cannot go wrong with the rate. This article examines a recent seemingly logical discussion on the withdrawal rate, questioning its viability, and testing it over historical market conditions.

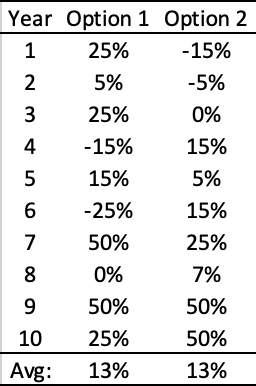

Imagine that your investing journey is about to start today, and will continue for the next decade i.e. you will be investing increasing sums of money each year (in monthly instalments - SIPs) for the next 10 years. You have the choice of picking up the sequence of returns that you earn between the following two options (they both average to the same number):

To make the comparison easy, here is journey of an investment of 100 units of currency in each option:

When both the options end at the same number, does the sequence of returns matter? And if it does, which one is better - lower returns initially, or higher returns initially? What happens when you turn the table - i.e. you are not in an investment phase, but in retirement - how do these considerations change. Take some time to think about these issues before reading the answers in this article. This is such an important concept - I would urge everyone to read this article.

In his latest, Morgan Housel makes an interesting distinction about people who spend less than they earn. Most personal finance texts will advocate spending less, or being frugal. But as Morgan demonstrates, spending less does not necessarily mean being frugal. It is a different mindset for many people.

Before we end this, a heartfelt gratitude for all that Charlie Munger taught us in his 99 years of existence on this planet. We are truly blessed to have lived in the same time as him. He will continue to be with us for generations through his teachings, like the following two resources:

The Charlie Munger Manifesto by Vishal Khandelwal, which contains his most important rules for living a good life, and avoiding bad outcomes.

Revised Poor Charlie's Almanack - a new revised edition that Charlie was himself involved with is now available for pre-order (kindle version as well)

* * *

That's it for this weekend folks.

Have a wonderful week ahead!!

- Tejas Gutka

[Dec 23, 2023]

P.S.

You can read the past issues in the best of series here: