[The Weekend Bulletin] #48: Ingredients of Long Term Value

+ building a personal moat, expecting the unexpected, and more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

What makes a great dish?

"First and foremost, it’s great ingredients. You can be the most talented chef on the planet but if your ingredients are second rate your food will be too.”

quotes the Michelin Guide. The Guide then goes on to talk about other things like balance, consistency, creativity, skills, etc - the softer aspects. And while you cannot undermine the importance of any of those, for the sake of this issue, let's stick with the ingredients.

Just as the ingredients come first and foremost in the making of a great dish, so does the quality of your investments in creating long term value. However, like ingredients, quality is a vague (and probably over-used) term. Which ingredient matters the most? Is it the main vegetable or meat? Or is it spices that go into the gravy? Or the condiments? Is it high profit margins, or a high market share, or high returns on capital, or a high working capital turnover? Does growth matter when we discuss quality? If yes, then how much? Are fast growing businesses better quality than slow growing ones?

As you would have guessed by now, this issue tries to answer some of those questions. But before we go on to the regular articles, there was something else in the Michelin Guide that caught my attention.

"I’m often asked what the best thing is I’ve ever eaten. It was in Tokyo and it was sliced mango. That was it – slices of mango on a white plate."

You must be wondering why that needs to be mentioned here? Well, you’ll know as you read through the issue. But before I let you do that, there is one last thing that I want to talk about.

In addition to the ingredients mentioned above, there is one more ingredient that remains extremely important but often missed - Time.

Time is the flame that simmers raw ingredients into a well-cooked dish. And just as a delicacy comes from the finest ingredients cooked slowly, allowing for the ingredients to interact with, and to influence, each other, so does long term value. While cooking doesn’t always rely on the heat of the flame, time is an integral part of investing.

Bottom-line: A long term value seeker can neither compromise on the ingredients, nor cook on a fast flame.

Section 1: Investing Wisdom

The main ingredient: Who better to talk about the main ingredient than someone who studied 100-baggers (stocks that returns a 100x) and wrote a book about them. Chris Mayer reflects upon the most important ingredient that goes in to making a 100-bagger.

The sides: Just as a multi-course meal has the main dish and the sides, so does an investment portfolio. There are the main drivers of long term value and then there are the appetisers and the desserts. In this slightly dated interview, value investor Glenn Greenberg goes into the detail of his investment process that has helped him achieve the following:

"We started with $40 million (in 1984), 2/3rds of which was family money. By 2006 we compounded that to 100x its original value before fees just by concentrated invest- ment in pretty pedestrian, easy to understand businesses that seemed under-valued. That meant no turnarounds, no crummy businesses, no highly competitive businesses, and no tech businesses, which we didn’t understand. It was boring stuff.”

Talk about Mango slices on a white plate being the best meal ever!!

The condiments: Valuations are like the condiments. Not the most important ingredient, but definitely can not be left out. This article summarises a recent Michael Mauboussin paper on how growth, return on capital, and the discount rate affect valuations. This is important to understand, particularly in a world where interest rates are being held close to (or below) zero.

This article provides the reason why condiments cannot be left out. Proponents of the coffee can approach believe that great businesses deliver outstanding returns, irrespective of their valuations, over long time horizons. However, what they do not appreciate is that the long term is made up of a lot of short terms. More importantly, the long term may be a little too long for the average investor. The article draws from history to demonstrate this.

The following aptly summarises this section:

Source: Bharat Shah’s Rules of Thumb to Create Value (edited).

Section 2: Mental Models & Behavioral Biases

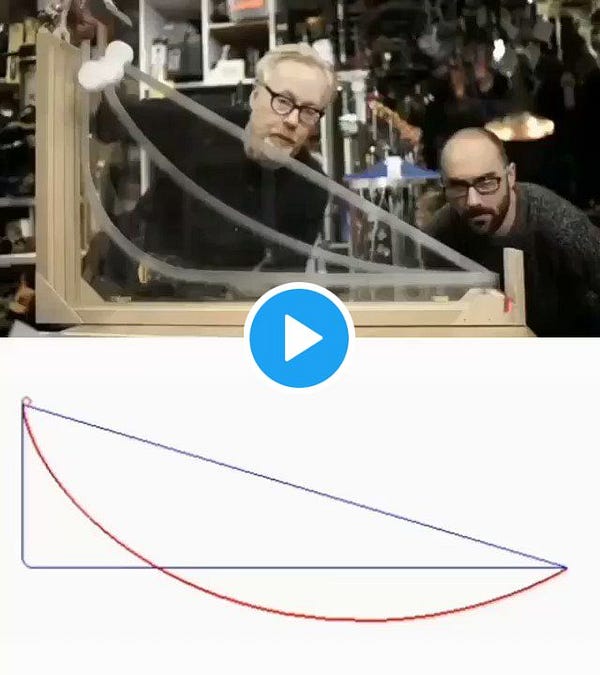

Remember last week’s trivia? Which path did you choose, A or B or C?

While path A is the shortest, path B is the fastest, as you can see below.

A lesson in Second Order Thinking - the shortest path may not be the fastest (it is, in fact, the slowest).

These are two important mental models that need to be understood well in the internet age. But rather than giving them to you directly, I thought of asking you to think about them first. So here goes:

What is the difference between email and gmail?

(Hint: two different types of moats make each of them successful respectively).

Section 3: Lessons From History

Read this if you are a fan of the Marvel Cinematic Universe (MCU). Read it to understand how dynamic the world of business is - from filing for bankruptcy to the first major MCU release, in a little over a decade - and how much uncertainty the future holds. Read it also to understand why diversification matters.

Section 4: Personal Development

Here are two further reads, following up on last week’s advise on building a personal moat:

In case last week’s nudge on building personal moats was not enough for you, then here is an extract from Naval Ravikant’s famous ‘How to get rich without getting lucky’ on The Four Kinds of Luck (how building a personal moat will make you lucky)

Further, in case you are looking for specifics, then Scott Adams (of the Dilbert fame) has some career advice for you here.

Section 5: Trivia

Weird things happen all the time. In fact, one of the things that I am trying to get myself to accept more readily is that things that are contrary to my logical beliefs are very likely to happen all the time.

Consider for instance what happened when Singapore airlines decide to convert their grounded aircrafts into restaurants (to fund some of their losses): they were sold our in 30 mins.

That someone would want to eat in the cramped seat of an aircraft (that too airline food!) and pay for it, completely beats me. But ‘expect the unexpected’ is what I tell myself.

* * *

That's it for this weekend folks. I hope that you enjoyed this issue; let me know your thoughts/feedbacks by commenting below.

Have a wonderful week ahead!!

- Tejas Gutka

[Oct 24, 2020]

P.S.

If you come across an interesting article that you feel is insightful and worth sharing with the community of readers of The Weekend Bulletin, please email a link of the article along with a short summary/note on why you like the article to: share2TWB[at]gmail[dot]com.