[The Weekend Bulletin] #69: Older = Better?, Empty Vessels/No Noise, Right Management,...

...Growth α Return on Capital, Time Management, Margin of Safety, and more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Hola, and welcome to the new financial year!

Care for a silly joke?

Its summers in India and this is Issue 69, so….

I got my first real six-string

Bought it at the five-and-dime

Played it 'til my fingers bled

Was the summer of '69

Told you, it was silly.

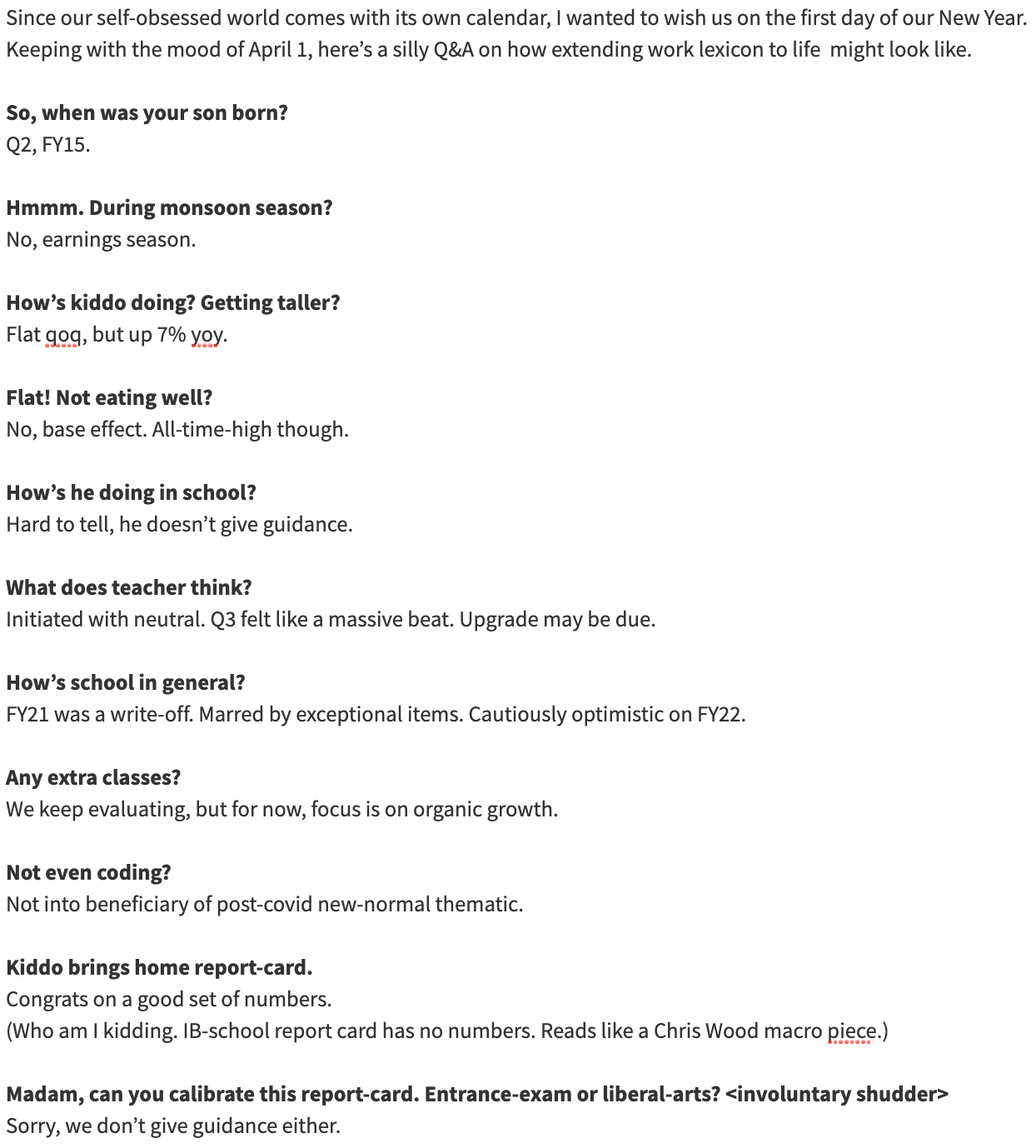

Here’s something more intelligent, celebrating the spirit of the financial year and April Fool’s day:

Let's get on with business now...

Section 1: Investing Wisdom

There’s an old adage that with age comes wisdom. But do we become better investors as we age? Two conflicting forces might be at work: the wisdom older investors gain from their experiences, and the possibility of diminishing cognitive abilities. Which one do you think will out-weigh the other? Read on to find out.

Nicholas Sleep (whom we met in Issue 58) has been an early and strong proponent of 'scaled economies shared'. His letters make for a very educating read. This thread discusses a section of his June 2009 letter titled "Empty Vessels and a Quieter Approach". It talks about how some businesses, by virtue of the strength of their model, need not make noise about their services in order to grow.

Of course, taking Nick's above idea to an extreme is hazardous to one's wealth. As this entrepreneur recounts, having a good product does not guarantee you success. For some businesses, making noise (aka marketing) is an extremely important tool in their arsenal.

Imagine 2 businesses, S and F: S is a Slow Growth business. Its earnings grow at 6% per year. F is a (relatively) Fast Growth business. Its earnings grow at 9% per year. Both businesses are trading at 15 times earnings. Which is a better investment? Intuitively, F looks like a better bet, but as you would have figured, the answer is not that straightforward. Read on to find out why.

Section 2: Mental Models & Behavioral Biases

Some interesting mental models around evaluating managements and self-developement:

Learning to identify super talented people before others is one the most underrated skills an investor can develop. As more and more decisions, especially in investing, are being delegated to data, the people aspect is getting overlooked more and more. Here is how you can develop an edge in identifying some great business operators.

Different conditions call for different measures. A dry pitch may favor spin bowlers while a green pitch may favor pacers. Similarly, different businesses require different types of operators, depending on where they are in their lifecycle. It is important for investors to understand what kind of management best suits the business being investigated, and for this, ants may serve as a good guide. This article explains how.

The above article makes a water-tight distinction between the two types of managements that are needed at different stages of a business' life cycle. However, history is replete with examples where management's have taken their styles to an extreme, leading to an eventual death of the business (think of Kodak which killed innovation). Therefore, it is important to have a good mix of the two styles - an ambidextrous mindset. Companies like 3M and Google are good examples of this mindset where they deliberately budgeted time to explore new avenues while exploiting existing markets. This article looks the two mindsets and explains how to merge the two into a nice cocktail.

Section 3: Personal Development

A happy and satisfied 30 year having lived a full-filling life may sound like a bit of an oxymoron. Most 30 year olds have a false sense of a mid-life crisis, complaining about a demanding boss, a boring job, and a nagging wife. Not our author. He claims to have lived such a full-filling life that he would have no regrets going off tomorrow. So when this stoic (Ryan Holiday of the Daily Stoic) doles out advice on how to live a full life, shouldn't we all listen? Follow along here.

Talking about stoics, one of my all time favorite stoic writing (though I haven't read as many as I would like yet) is a letter by Seneca titled 'On the Shortness of Time' (so much so that I have shared it here more than once already). What I really like about the letter, other than its extremely practical advise, is the fact the it was written centuries ago and is still very relevant today (the part where Seneca compared time with money is really hard-hitting and profound in my view). Thus, every time this letter resurfaces on my timeline, I make sure to give it a read. This one though, is not just about Seneca's letter but goes one step ahead in identifying four ways that we misunderstand time and what we can do about it. Please read this, for,

"Wealth is created not by spending your time making money but rather by saving your time to make money."

Quotable Quote

"Maintain a margin of safety—even when it’s going well.

Rich people go bankrupt chasing even more wealth.

Fit people get injured chasing personal records.

Productive people become ineffective taking on too many projects.

Don’t let your ambition ruin your position."

* * *

That's it for this weekend folks.

If you enjoyed reading this issue → please hit the like button

If you have any feedback/interesting articles that you’d like to share → simply reply to this email/leave a comment below.

Have a wonderful week ahead!!

- Tejas Gutka

[April 03, 2021]