[The Weekend Bulletin] #52: 1Yr Anniversary, Investor vs Investment Returns & Volatility,...

...Playing the Loser’s Game, Narrative Fallacy, Early Retirement, & more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Two announcements before get to business:

1. TWB Turns 1!! 🥳

Hurray!! This labour of love is now a year old. Thank you for joining me on this journey towards life long learning. This bulletin is as much because of you, as much as it is because of me.

Hopefully, this is the first of many milestones to come ahead.

Cheers!! 🍻

2. TWB will be taking the next weekend off. 🍹

You won’t hear from me next weekend (Nov. 28). We’ll be back in business from the first weekend of December.

Section 1: Investing Wisdom

Numerous studies have found that, on average, an investor’s return is always lower than the underlying investment’s returns. No, it's not due to the high fees that are usually blamed, coz investors tend to underperform the fund that they invest in as well. More importantly, this gap would persist even when you looked at an index investor. This article explains why this gap exists, and what can be done to narrow it.

Compounding the problem of an investor earning lower returns than the underlying investment, is the fact that investors also experience much higher volatility than the underlying investment. Thus, on a risk-adjusted basis, the investor is much worse off than the underlying investment. This article explains how.

While on the topic of volatility, this is an interesting thread:

Source: Jonathan Rubin on Twitter (Originally from the book ‘100 Baggers’ by Chris Mayer)

One of the reasons that investors experience lower returns and higher volatility than the underlying investment is because they are playing the game wrong, claims this article. Instead of playing to win like the hare in the famous fable, they should play to not lose like the tortoise, it suggests.

The other reason that investors often experience lower returns and higher volatility, also a reason that bubbles are formed, is Envy. There is a reason the Charlie Munger calls Envy one of the worst sins; this article explains why.

Section 2: Mental Models & Behavioral Biases

Stories help us make sense of the world easily. We often rely on stories to hold together facts in our minds. This tendency of ours to see events as stories is called Narrative Fallacy. One of the places that the Narrative Fallacy shows up in a big way is in investing (so much so that Prof. Damodaran wrote a book on it). This Ted talk, albeit not about investing, provides a very good primer on this fallacy (much recommended).

Section 3: Personal Development

Almost everybody invests with the end goal of securing life after retirement. Some, however, go one step further with a goal of early retirement. The below two articles are directed towards these dare-dreamers by someone who is living that dream:

Want to have a great day? Tell yourself the night before that you are going to die in your sleep. Confused? Read here why Seneca thought this was a good idea.

Section 4: Trivia

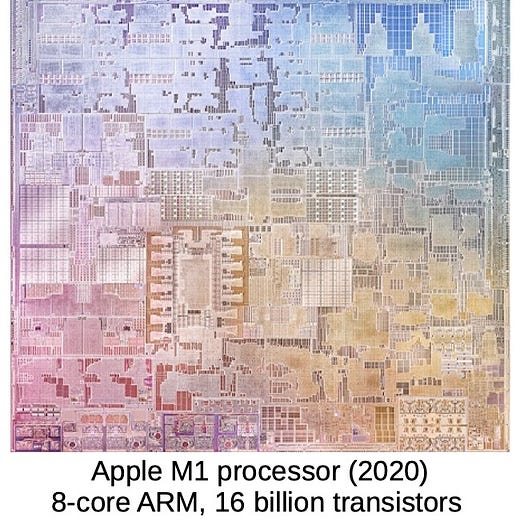

Apple recently announced the transition of all Macs to its own Chipset (M1) ending a legacy with Intel. Here is some trivia around the same:

Moore’s Law in action (comparing Mac’s first chipset to the latest) - 16 billion transistors vs 25 thousand; pixel-sized spec; 500 times faster; 12MB vs 100 bytes!!

A full circle back to history [partly-owned chips (via ARM) -> Outsourced Chips (Intel) -> Own Chips (M1)]:

Compounding of Small Changes, Disruption, Apple’s Legacy and WHY INVESTORS SHOULD PAY ATTENTION TO TOYS:

Source: Benedict Evan’s newsletter

Quotable Quote:

"Not enough is said about the power of thinking about one topic for a long period of time.

If you revisit a topic continually for a few years, most problems (and many solutions) will occur to you at some point.

Expertise can be the gradual accumulation of many modest insights."

Source: James Clear’s phenomenal weekly 3 ideas, 2 quotes, 1 question

* * *

That's it for this weekend folks.

If you enjoyed reading this issue -> please hit the ♡ button

If you have any feedback/interesting articles that you’d like to share -> simply reply to this email/leave a comment below.

Have a wonderful week ahead!!

- Tejas Gutka

[Nov 21, 2020]