A digest of some interesting reading material for the discerning investor. Your weekly dose of multi-disciplinary reading.

Our mind works in amazing ways. From optical illusions to logical delusions, it tricks us constantly; often projecting our perceptions as reality. We are all aware of the placebo effect - something that looks like a real medical treatment, but isn't. But did you know that the opposite of placebo is also true - something that might seem like a dangerous drug, but isn't? There is even a name for this effect; this article has all the details.

Such are the fallacies of our mind. What can we do about them? We can either suffer these fallacies unknowingly (ignorance), or observe them knowingly (awareness - through study), or use them to our advantage (resourcefulness). Arnold Van Den Berg (whom we met in #91) talks about the struggles of his life and how he used the power of belief to overcome them (he also talks about investing, but the power of belief is what stuck with me) in a recent podcast (h/t to Vinay Mishra for highlighting this podcast). AVDB has been a student of the power of the sub-conscious mind for decades, and he lays down a simple, self-tested, exercise that we can all practice in order to become better at our endeavours. His success at using this method should encourage you to try it out. Ever since I heard this talk, the following lines from this song have been stuck in my head:

If I can see it

Then I can do it

If I just believe it

There's nothing to it

Compliment the above podcast with this short video

Among other things,

Jason Zweig reminds us in a recent column that "The point of investing isn't to finish first. It's to finish."

Nick Maggiulli explores Why Buying the Dip is a Terrible Investment Strategy (#83 had other articles in this series listed)

Ho Nam argues that investing is neither a bet on markets or a bet on people.

Joe Wiggins argues that 'There is plenty of talk about behaviour, but unfortunately not much action'.

One of the things that an investor needs to have a high tolerance for is uncertainty. Mark Mason has some suggestions on how we can become comfortable living with uncertainty (the link will take you directly to section 4 of the article from there I think one should read it. You can scroll to the top in case you want to read the article from the beginning).

Lastly, stressed out? try this simple breathing exercise.

Blast From The Past

Revisiting articles from a past issue for the benefits of refreshing memory and spaced repetition, as well as for a fresh perspective. Below are articles from #21:

There is a well-known acronym used in data-science called 'GIGO', expanding to 'Garbage In and Garbage Out', which means that the quality of output is determined by the quality of the input. An analogy to this for the world of investing would be that a good process should always lead to a good outcome. However, we know that this is not always true. It not always true due to the influence of a number of forces acting in different directions. One such force is randomness, or luck. Here is how luck plays a role in investing, and in life in general, from the foremost authority on the subject - Michael Mauboussin's book, The Success Equation.

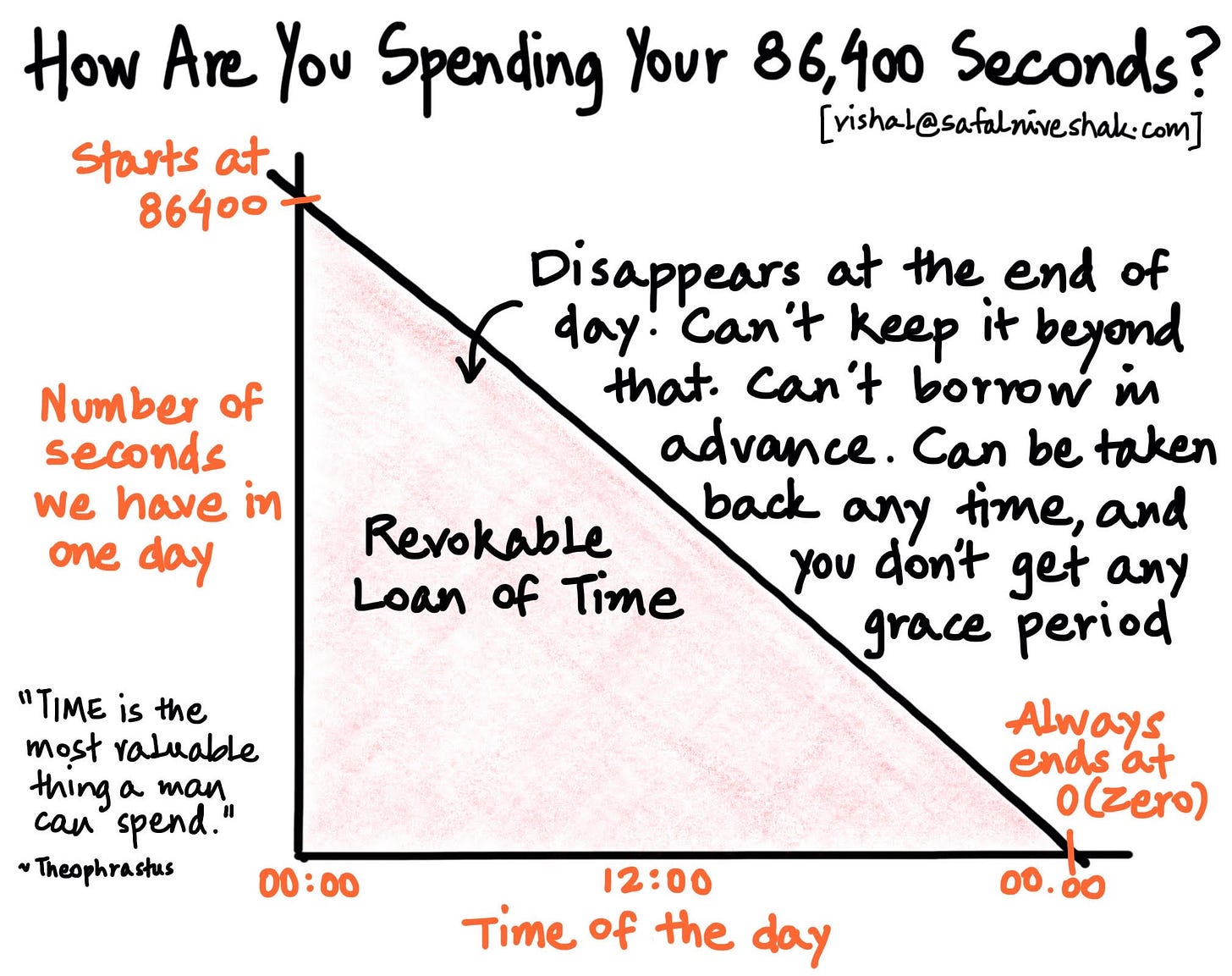

If, like me, you are somehow struggling to make the most of the time on hand currently (due to savings on travel, meetings, water-cooler conversation etc) then the following may provide some motivation: Imagine that a deposit of 86,400 is made into your account each day, with the entire amount disappearing at the end of the day. You are free to do whatever you wish with this amount and the prior knowledge that this deposit can stop at any time without advance notice. What would do? I would say spend some of it, but invest most of it so that you can have more than 86,400 per day in the future. Now replace the 86,400 as a currency with time, and this fable will come to life. The rendition below is a nice representation of the concept:

Source: SafalNiveshak

Readworthy Passage

Let's read together a random, but read-worthy, passage from a randomly picked book.

Worry is harmful, the shrinks assure us. They offer no trustworthy evidence that the statement is true. It has become accepted as true through sheer relentless assertion.

Devotees of mystical and meditational disciplines, particularly the eastern varieties, go still further. They value tranquility so much that in many cases they are willing to endure poverty for its sake. Some Buddhist sects, for example, hold that one shouldn't strive for possessions and should even give away what one has.

The theory is that the less you own, the less you will have to worry about.

The philosophy behind is, of course, the exact opposite.

Perhaps freedom from worry is nice in some ways. But any good Swiss speculator will tell you that if your main goal in life is to escape worry, you are going to stay poor.

You are also going to be bored silly.

Life ought to be an adventure, not a vegetation. An adventure may be defined as an episode in which you face some kind of jeopardy and try to overcome it. While facing the jeopardy, your natural and healthy response is going to be a state of worry.

Worry is an integral part of life's grandest enjoyments. Love affairs, for instance. If you are afraid to commit yourself and take personal risks, you will never fall in love. Your life may then be as calm as a tidal pool, but who wants it? Another example: sports. An athletic event is an episode in which athletes, and vicariously spectators, deliberately expose themselves to jeopardy -- and do a powerful lot of worrying about it. It is a minor adventure for most of the spectators and a major one for the athletes. It is a situation of carefully created risk. We wouldn't attend sports event and other contests if we didn't get some basic satisfaction out of them. We need adventure.

Perhaps we need tranquility at times too. But we get plenty of that at night when we sleep -- plus, on most days, another couple of hours at odd times while we are awake. Eight or ten hours out of twenty-four ought to be enough

- From the THE ZURICH AXIOMS by Max Gunther

Quotable Quotes

Your wealth is like your children — the primary link between your present and the future. You should try to think about it in the same way. You want your children to have freedom but you also want them to be good people who can take care of themselves. You don’t want to blow it, because you don’t get a second chance. When you invest, it’s not your wealth today, but it’s your future that you’re really managing.

- Peter Bernstein

* * *

That's it for this weekend folks.

Have a wonderful week ahead!!

- Tejas Gutka

[Sep 25, 2021]

Deeply humbled for the mention. 🙏🏼

Keep going. More power to you!