[The Weekend Bulletin] #84: Insider Perspectives 👀, Manufactured Memory 🧠,...

...Screening, Forecasting, Goal Setting, Facing Challenges, and more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Section 1: Investing Wisdom

Wouldn't it be great if we could get an inside perspective on companies - like how does it feel to ride a compounder while working in it, or how do business operators deliberate strategic decisions? Thanks to the internet, we can afford a few sneak peeks:

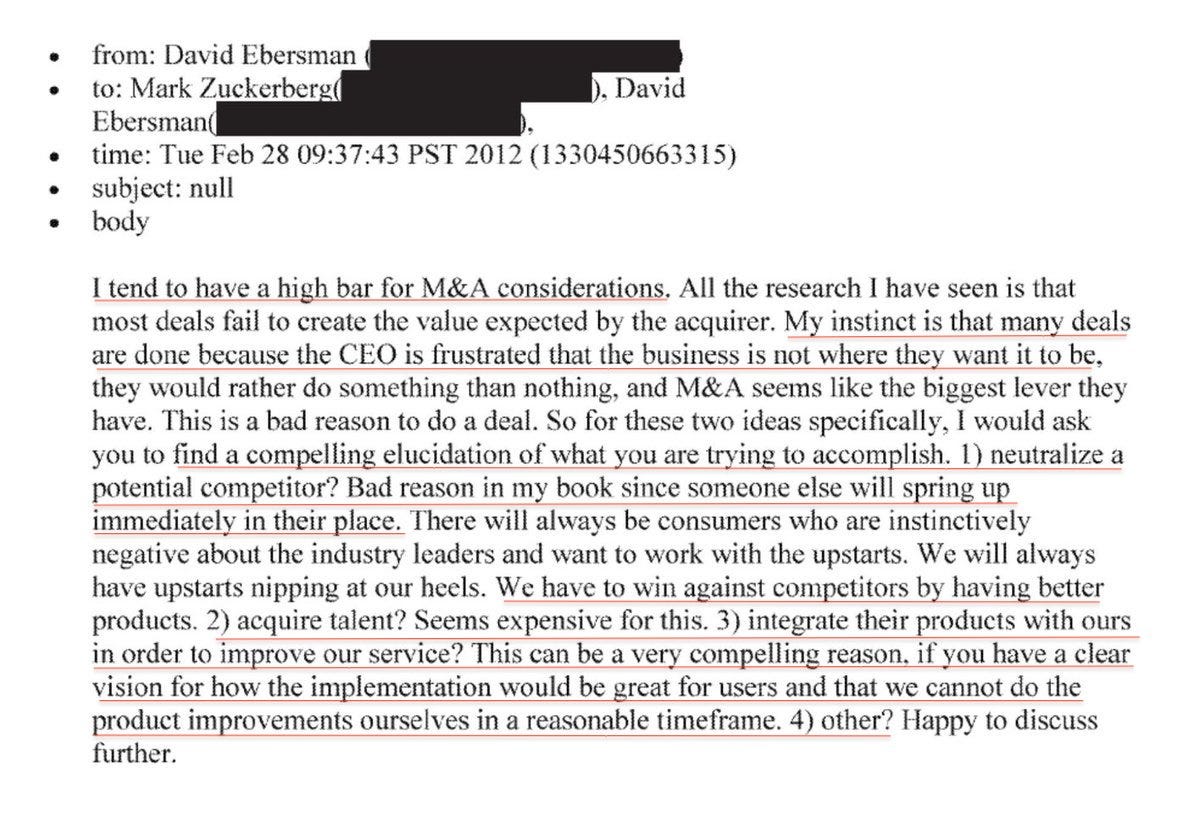

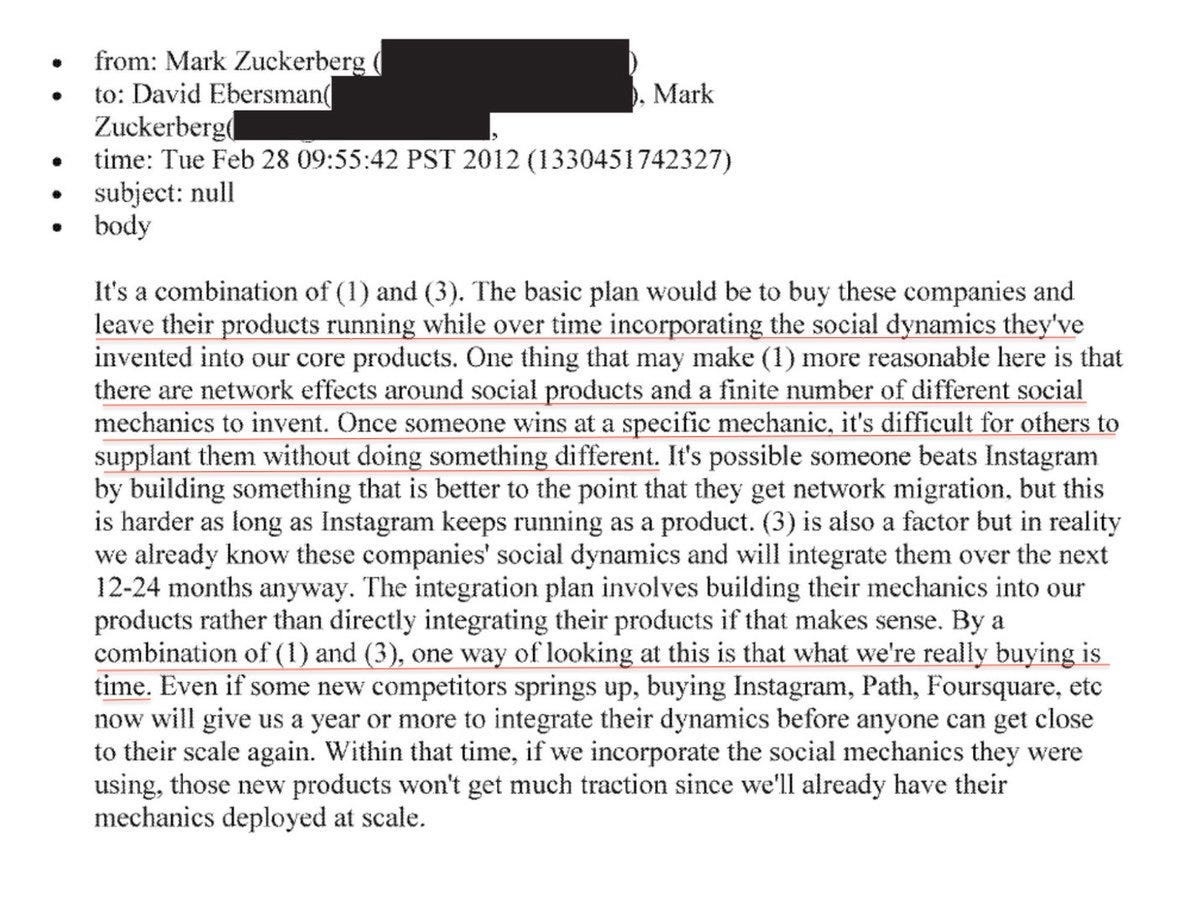

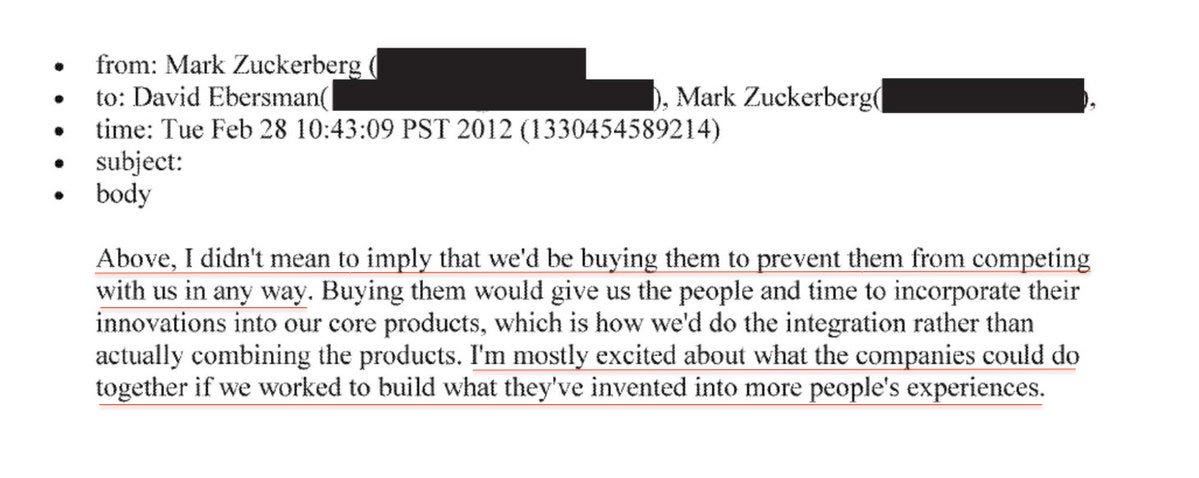

An interesting discussion between Mark Zuckerberg and his CFO around the acquisition of Instagram (love the M&A framework described by David). I wish there were more such ways in which you could get into the head of decision makers at pivotal moments in their careers.

Source. (You can follow-up the above with this conversation between Mark Zuckerberg and Kevin Systrom on Instagram acquisition)

This thread provides a simple yet powerful framework to identify compounders. An insider condenses his experience of working for a company that went 30x in ten years (wasn't a tech company) in to seven simple lessons.

Lesson 4 in the above talks about the second act, which is elaborated here.

The act of investing is an interesting combination of the past and the future. We look to the past to understand a business, while we dream up a future to value it. Below are some frameworks for each of these activities:

Stock Screening Frameworks (multiple-links; worth bookmarking)

Section 2: Mental Models & Behavioral Biases

Often, when we are reminded of the past (either through an old photo or video, or through someone narrating an event to us), we either remember it differently or have no recollection of it. This happens due to the way our brain functions - instead of storing entire memories of an event, it stores a summary; over time, this summary get fuzzy, and so the brain starts filling up gaps with vivid imaginations. This is a mental fallacy called manufactured memories and is something that investors should especially pay attention to.

"Every time you pull out a piece of information from memory, you get back the gist which has a lot of missing details. To comprehend that piece of memory your brain regenerates some part of it on the fly by imaginatively filling in the missing details with stuff that seems plausible, whether or not it’s actually what happened.

This reconstruction of any piece of memory happens not just once, but every time we access it. So the next time we remember it, we’re pulling up false details; maybe we’re even adding new errors with each act of recall. Presence of this feedback loop in memory reconsolidation compounds the problem over time."

(This is one of the reasons why it's so important to create a system to not only record your decisions, but also review them periodically. Imagine what happens otherwise - your brain will justify every wrong decision you have taken, providing an incorrect feedback loop. If you know or have a system for this, can you talk about it here?)

Section 3: Personal Development

Last week, we saw how different personalities need different productivity methods (and how to find the one that suits yours). Taking this argument further, different personality types need different goal setting methods. Here are five unconventional goal setting methods that you can pick from.

Productivity systems may not be your thing. You may not even think much of goal setting. However, there is something that you just cannot ignore. Love them or hate them, but you cannot escape the challenges the life throws at you. Here are 6 principles for navigating life's challenges. Loved the concept of 'rugged flexibility':

"To be rugged is to be tough, determined, and durable. To be flexible is to adapt and bend easily without breaking. Put them together and the result is a gritty endurance, an anti-fragility that not only withstands change but can thrive in its midst. The principles and practices below can help you develop rugged flexibility."

Section 4: Blast From The Past

We consume a lot interesting text in our quest for knowledge. However, with each new byte of data that we feed into our memory, we lose some bit of old information that was held. Even without the addition of new information, our memory regularly cleans our information that is held deep and not often retrieved. If is for this reason that re-reading old texts (books/articles/notes) is highly recommended.

There are other advantages to re-reading. Spaced repetition for one - when we revisit some old material, it is etched better into our long term memory. More importantly, as we gain more experiences in life, re-reading an old text can provide some fresh perspectives that we may have missed while reading earlier.

It is to reap these benefits that this section revisits article/s from an earlier issue. Below are articles that first appeared in the twelfth issue of TWB:

This article touches upon a tenet of investing that remains highly under-appreciated. Investing is not a binary operation - either black or white. Rather, like most things in life, the best of investing lies in the gray. A good investment philosophy finds a balance between opposing forces.

Most of us are conditioned to prefer a bird in hand against the two in the bush. But what if there are conditions where the two in the bush offer a better deal? That's the mental model of this week: Hyperbolic Discounting.

(In some ways this mental model requires one to have a balance between greed and instant gratification - two opposing forces as referred to in the preceding article).

Quotable Quotes

Letting go:

On attention and distraction:

📢 Shameless Self-Promotion

Before you go, I wanted to share some of my work that was published recently:

BBF Magazine Article - The Need for An Investment Philosophy

The Sound Of Money Podcast - Wealth Creation & The Power of Compounding

* * *

That's it for this weekend folks.

Have a wonderful week ahead!!

- Tejas Gutka

[Jul 17, 2021]

Hey Tejas!

Great content as always. Even your Blast from the Past section is something to cherish.

I am of the view that an Investment Philosophy should be a work-in-progress rather than a crystallised concept. Your articles help shape mine.

Keep up the great work!