[The Weekend Bulletin] #199: Valuation is Not As Important, Bubbles Are Good, Index Is A Better Investor, ...

... Creating An Experimentation Lab In Portfolios, Rowing In The Same Direction, 5 Habits for Better Thinking, and more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Investing Wisdom

We've often read about the value of experimentation in business - 3M was famous for driving innovation through experimentation, and so was Google. Jeff Bezos adopted a similar approach since the early years of Amazon. The author of this blog post advocates that investors should also adopt a similar approach in their portfolio construction process by creating a small experimentation lab in their portfolios.

'Valuation is not as important as quality' claims famed investor Terry Smith of Fundsmith in this interview. While he agrees that undervalued stocks have the potential to generate high returns, he still prefers quality over valuations.

This article reiterates an important consideration that we read about in #47 - 'for most fund managers nothing is more important that adopting a long term approach...yet this is not often possible. ... Even when a fund manager’s express intention is to operate with a long time horizon, often they cannot because it is decided by the behaviour of other people. They don’t get to choose.' Therefore, the article advocates that it is important to ensure that everyone is rowing in the same direction.

While we usually read about the investment process of active investors - the tools and filters they use to select outperforming stocks - this post takes the other side of the argument. It explains why the index itself is a reasonably good investor, devoid of many biases that individual investors (professional and otherwise) face. If you are a proponent of index investing then this post will support your cause. If you are an active investor, then this post will explain what you are up against.

Bubbles usually carry a negative connotation, and rightly so - they are usually a result of excessive greed and optimism. However, as we read in #106, while bubbles are bad for investors, they are good for society. Let this post explain.

Personal Development

A former CIA analysts lists five habits that can help you master the art of thinking. He distills these habits from the Structured Analytical Thinking frameworks that intelligence analysts use to diagnose a problem, challenge their thinking, or anticipate future scenarios.

Blast From The Past

Revisiting articles from a past issue for the benefits of refreshing memory and spaced repetition, as well as for a fresh perspective. Below are articles from 122:

First up is this talk recent talk by Howard Marks on Risk in Investing. This is a subject on which he has written three memos [Risk (2009), Risk Revisited(2014), Risk Revisited Again (2015)] which he recounts here, and elaborates further on:

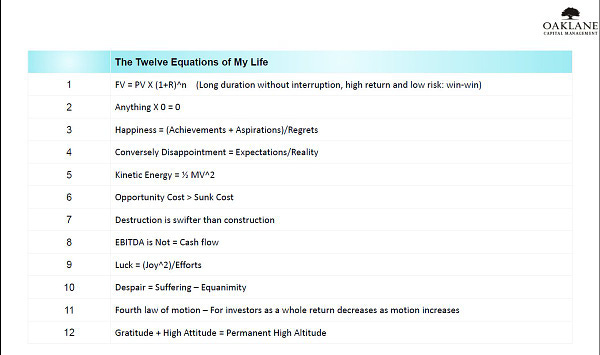

Next up is the latest episode of The One Percent Show where Vishal Khandelwal interviews Kuntal Shah. Kuntal bhai unpacks so much wisdom in this single episode, leaning on his extensive reading and deliberations. He also shares a long list of book recommendations all through the episode. Great listen, and a wonderful start of the interview with the twelve equations:

Quotable Quotes

“Everyone has their own character flaw or personality disorder when it comes to money emotions.

Managing those emotions is even more important than how you manage your portfolio.”

- Ben Carlson

“The same traits needed for outlier success are the same traits that increase the odds of failure. The line between bold and reckless is thin. So be careful blindly praising successes or criticizing failures, as they often made similar decisions with slightly different levels of luck.”

- Morgan Housel

"The beginner chases the right answers.

The master chases the right questions.”

- James Clear

* * *

That's it for this weekend folks.

Have a wonderful week ahead!!

- Tejas Gutka

[Jun 08, 2024]