[The Weekend Bulletin] #127: Momentum vs Value, Slow Haste, William Green, Jim Simons,...

...How to Succeed, A Good Day, Improve Your Position, and more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Investing Wisdom

Different schools of thought act differently. On the one hand, value investors look for beaten down and out of favour names. On the other hand, momentum investors believe that what goes up will continue to go up, and vice verse. Which is these schools to follow? Recent research looked in to this dichotomy, and came out with interesting findings about value and growth stocks. Here is a summary of the research.

Two pieces of advice(from the same author) that are worth their weight in gold:

How to Succeed as a Sell Side Trader (dont go by the title; the advice applies as much to a long term investor as much as it applies to a trader. Strongly recommend reading this)

Consider this: 'to get where you want to go the fastest often means acting very slowly if at all'. Confused? This article explains what it means and how it applies to investing.

Here's another great listen from the One Percent Show. In this episode, host Vishal Khandelwal and guest William Green (author of Richer Wiser Happier) talk about compounding goodwill (a similar conversation was in the episode with Guy Spier), living a fulfilled life, Charlie Munger, and more.

Jim Simons interviews rarely end up in the public domain. A new one just popped up that you can watch here, or read the highlights here.

Personal Development

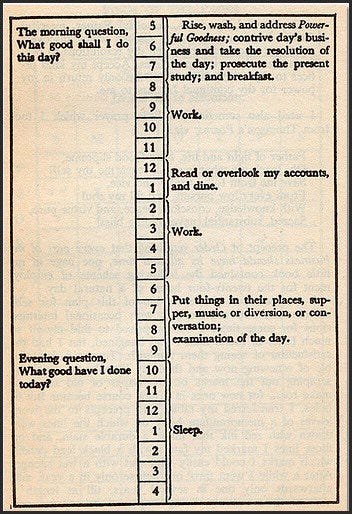

If you were to emulate someone's day or journal prompts (LHS in the image below), let that be of Benjamin Franklin:

“My whole life has been spent trying to teach people that intense concentration for hour after hour can bring out in people resources they didn’t know they had.”

- Edwin Land

Courtesy: this tweet

Tiny Thought:

The position you find yourself in determines the options available.

Almost all the options available are positive when you put yourself in a good position. When your position is bad, however, almost all the options available are negative. That's not to say good outcomes can't come from a bad position, but there are no points for playing on hard mode.

There is always something you can do to improve your position. While this seems deceptively simple, there is a lifetime of wisdom behind it.

You can’t predict what will happen tomorrow, but you can improve your position by sleeping, eating healthy, and working out. You can’t predict what the stock market will do tomorrow, but you can improve your position by ensuring you are never a forced seller. You can’t predict what will happen in your job or life, but you can improve your position by always having a little bit of money on the side. You can't predict if you will get a promotion, but you can put yourself in a position to get it by acquiring the skills you need before it becomes available.

Good positioning lets you control your circumstances. Poor positioning lets your circumstances control you.

When you are forced to act by circumstance, a chain reaction of increasingly poor choices follows.

- Courtesy Brain Food by Farnam Street

Blast From The Past

Revisiting articles from a past issue for the benefits of refreshing memory and spaced repetition, as well as for a fresh perspective. Below are articles from #52:

Compounding the problem of an investor earning lower returns than the underlying investment, is the fact that investors also experience much higher volatility than the underlying investment. Thus, on a risk-adjusted basis, the investor is much worse off than the underlying investment. This article explains how.

While on the topic of volatility, this is an interesting thread:

Source: Jonathan Rubin on Twitter (Originally from the book ‘100 Baggers’ by Chris Mayer)

One of the reasons that investors experience lower returns and higher volatility than the underlying investment is because they are playing the game wrong, claims this article. Instead of playing to win like the hare in the famous fable, they should play to not lose like the tortoise, it suggests.

Want to have a great day? Tell yourself the night before that you are going to die in your sleep. Confused? Read here why Seneca thought this was a good idea.

Readworthy Passage

Let's read together a random, but read-worthy, passage from a randomly picked book.

Confucius once said, “Real knowledge is to know the extent of one’s ignorance.” While most investing books focus exclusively on the steps you need to take to get rich in a hurry, I’m going to start off by going the other way with some negative knowledge. Negative knowledge is the process of first looking at what does not work to eventually come to the realization of what does. This process of elimination may seem like a minor distinction and a backwards way of looking at the world, but once investors are able to negate bad behavior, all that’s left over are improvements and better decisions. Negative knowledge can be much more powerful than positive knowledge because cutting down on unforced errors is so often the most important determining factor of portfolio results. It’s impossible to quantify opportunity costs, but most of the best investment decisions you will ever make will be the opportunities you turn down.

The very best investors know how to stay out of their own way. This doesn’t mean that every decision you make will be the correct one at the right time. That’s an impossible goal. But make enough good decisions over time and reduce enough unforced errors and your probability for success is much higher than the alternative.

Why focus on negative knowledge? Because study after study shows that investor performance suffers from some very basic mis- takes that should be relatively easy to fix. Investors pour money into the market at the top and pull their money out at the bottom, which has been shown to lead to an average loss of 2 percent per year in mar- ket gains. Increased trading activity from overconfidence can lead to another 1.5 to 6.5 percent in relative losses.1 These two issues alone could cost investors an entire year’s worth of market gains. One study looked at the brokerage data of individual investors to discover the 10 most important measures of poor investor behavior. They found that simply correcting these errors could improve individual investor returns by up to 3 to 4 percent per year.2 Think about it this way— the difference between a 4 percent annual return and an 8 percent annual return over 20 years on an initial investment of $100,000 is almost $250,000, just from correcting simple mistakes.

It can be very difficult to fix the simple mistakes though, because while it’s very easy to see the mistakes and biases in others, rarely do we notice them in ourselves. Figuring out where others consistently go wrong is one of the best ways to ensure your own success.

- From A WEALTH OF COMMONSENSE by Ben Carlson.

Quotable Quotes

(TR in the above refers to Thomas Russo).

* * *

That's it for this weekend folks.

Have a wonderful week ahead!!

- Tejas Gutka

[Jul 02, 2022]