[The Weekend Bulletin] #124: Conviction, Pitfalls of ROIC, Frequent Tail Events, Intelligent Fanatics,..

...Insider Trades, 10 Rules of Forecasting, Anchoring and Narratives, 7 Types of Rest, and more.

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Section 1: Investing Wisdom

In this recent interview, famed investor Stanley Druckenmiller talks about - among other things - what makes a good investor, when to sell, why managing emotions is tough, his biggest mistake, and more.

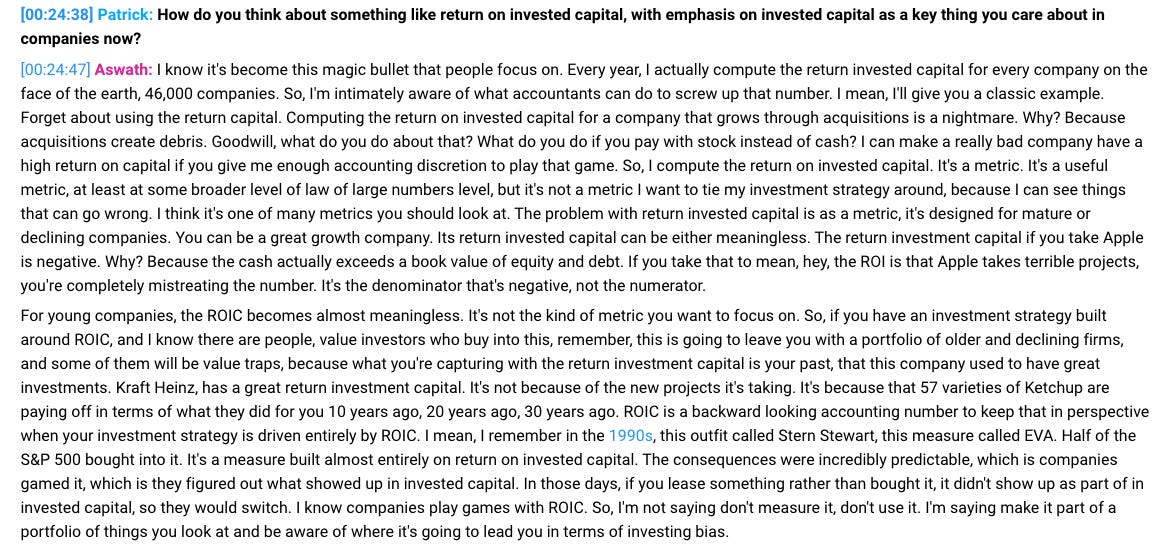

In a recent podcast, Prof. Aswath Damodaran elaborated on the downfalls of using return on capital alone as an investment strategy. The relevant conversation is appended below:

With the following description, could you guess what business is this:

"Researchers were allowed to spend 15% of their time investigating whatever they chose. Further, ...employees could push a suggestion past their direct report in the event they were getting pushed back on an idea....Once a researcher had proved him or herself to be an innovator (through new patents and products), their name was published in the * Innovators Hall of Fame, next to their patent, and was then allowed to spend up to half their time on projects they choose."

If you thought the above described Google or 3M, you were wrong. It is, in fact, the description of a textile company that this article talks about to highlight the importance of people in business.

"Interestingly, Milliken bet in completely the opposite direction to Buffett. As Buffett exited the textile business Milliken set about investing heavily in research and development to become the only remaining textile business in the US."

Insider trades (of the good kind - where owners and operators of a business buy or sell shares) carry a lot of information in them. There are strategies that mimc insider buy/sells to generate alpha. However, not all insider trades are equal. As this article explains, there is different value in insider buy/sells at 52 week high/lows, and away from them. Similarly, information about insider sales vs non sales are carry different values, based on past research.

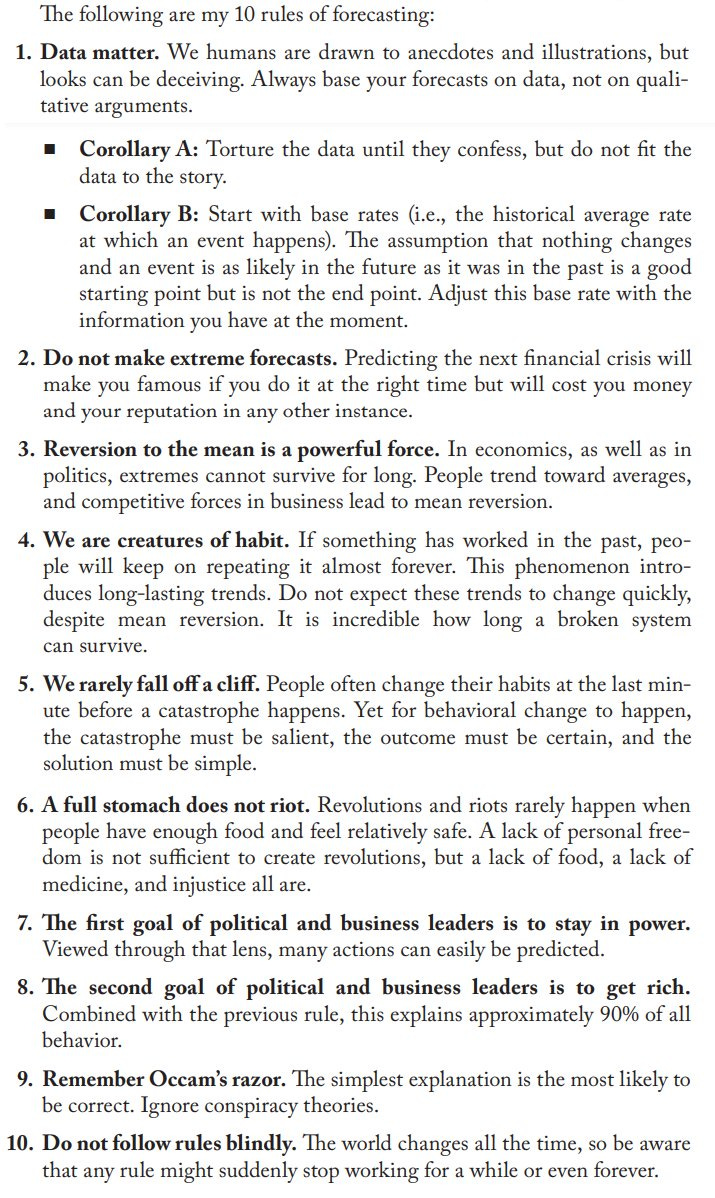

10 good rules to follow while forecasting:

Section 2: Mental Models & Behavioral Biases

This article looks at two fallacies w.r.t. investing: price anchoring and narrative fallacy. While each has its own pitfalls individually, the two together can have a serious impact on your investments. Some good examples in the article as well.

In his classic style, Morgan Housel explains why we experience 'once in a lifetime' events more than once. A good lesson in probabilities.

'‘With a large enough sample, any outrageous thing is apt to happen”

Section 3: Personal Development

I was aware of a couple of fatigues, like mental and physical. But I had no idea that there are more. This article lists 7 types of rests that we need, and why as well as how.

We are all aware of how the subconscious solves some of the tougher problems - the shower thoughts, or the famous Eureka moment. Given this knowledge, it is imperative that we create empty spaces for the subconscious mind to work, and ensure that it works on the right problems. While a lot has been written on the former (long walks, writing etc), not much has been written on the latter. This article tells you how and why the top idea in your mind matters. After reading it, you'll appreciate the following more:

Two good short reads:

"Your outer body will age with time but your inner body doesn't change.

When you connect with your inner body, you improve your natural healing capacity. Healing any internal wounds you have."

Section 4: Blast From The Past

Revisiting articles from a past issue for the benefits of refreshing memory and spaced repetition, as well as for a fresh perspective. Below are articles from #49:

Four short lessons from over a decade of investing by a self-taught investor. Not only are the lessons interesting, and relatable, but the author also goes on to talk about ten themes designed from his mistakes that he believes should be taught to CFA candidates. I believe that not just CFA aspirants, but many seasoned investors would also benefit if there ever was a classroom where these were taught.

He is the CEO of RARE enterprises. Over his long career, he has worked was marquee investment houses like ENAM, ASK, RARE and the likes. He is credited with bringing to the big bull’s focus a private equity style of long term investing. He has many a multi-baggers under his belt. Yet, he lives a low profile life and his wisdom is rarely found on the web. Thus, you wouldn’t want to miss Utpal Sheth recounting his investing lessons from a career that has spanned nearly three decades.

(P.S.: in Issue #2 we looked at a presentation by Mr Sheth detailing the megatrends philosophy that he talks about in this video)

Section 5: Readworthy Passage

Let's read together a random, but read-worthy, passage from a randomly picked book.

There are more things, Lucilius, likely to frighten us than there are to crush us; we suffer more often in imagination than in reality. I am not speaking with you in the Stoic strain but in my milder style. For it is our Stoic fashion to speak of all those things, which provoke cries and groans, as unimportant and beneath notice; but you and I must drop such great-sounding words, although, heaven knows, they are true enough. What I advise you to do is, not to be unhappy before the crisis comes; since it may be that the dangers before which you paled as if they were threatening you, will never come upon you; they certainly have not yet come. Accordingly, some things torment us more than they ought; some torment us before they ought; and some torment us when they ought not to torment us at all. We are in the habit of exaggerating, or imagining, or anticipating, sorrow.

- From LETTERS FROM A STOIC by Lucius Annaeus Seneca

(h/t: this article)

Quotable Quotes

My Guru told me “Be a bottle of water, not a bottle of soda.”

I asked my Guru, “Why?”

He replied “The bottle is you, the water your emotions. You may explode when shaken like a soda or be calm like water when shakened and opened. Do not let others disrupt your inner peace.”

One day, in retrospect, the years of struggle will strike you as the most beautiful.

- Freud

Forgive yourself for not knowing what you didn't know before you learned it.

You can only see as far as your headlights, but you can make the whole trip that way.

* * *

That's it for this weekend folks.

Have a wonderful week ahead!!

- Tejas Gutka

[Jun 11, 2022]

What you are doing is a great value additive service, I couldn't thank you enough. I have been binge-reading your blogposts.