The Weekend Bulletin (Vol. 1 | Iss. 17)

A digest of some interesting reading material from around the world-wide-web. Your weekly dose of multi-disciplinary reading.

Volume 1 | Issue 17 | March 14, 2020

What an eventful week this was!! Global markets yo-yo-ed between risk-on and risk-off, with the Indian market hitting a lower circuit and closing 5% higher than the previous day - all on the same day.

At the close of 2019, nobody in their right mind would have included a global pandemic as a risk to their investment outlook. Even as things stand today, we don't know for sure how bad things will get. We may possibly look back to this event as a blip and behavioral overreaction, or as a catalyst for a global crisis - one doesn't know for sure.

A lot of questions remain unanswered at this stage - how bad will this be?; how will be recover from this?; is the sell-off an overreaction? Should we average down?

While there are no definite answers at this juncture, one can seek some guidance by looking back at history. Although history seldom repeats, there are a few patterns that one can draw from history and use them for one's advantage. I hope you can find them in some of the articles below.

Section 1: Investing Wisdom

A general temptation during falling markets is catching a falling knife - averaging down your existing holdings. The usual argument in favor of averaging down is that if you liked something at 100, then you should definitely like it at 80 or 60. However, reality is never straight-forward - averaging down has been a destroyer of value in many a cases. Having said that, averaging down is not bad in and of itself; one only needs to be cognizant of when to average down. This article elaborates further.

Traditional wisdom favors investing in smaller companies over their larger counterparts mainly due to their ability to grow at a faster pace. However, does this traditional wisdom still hold true in the age of software abundance? Are larger companies better at adopting technology or are smaller companies better at technological disrupt due to their agility? This article throws some light on the matter.

While the above discussion is about small vs large companies, how do mid-sized companies fare? Further, is revenue growth the right metric or should one consider profitability as well? Read on to find out.

Section 2: Mental Models & Behavioral Biases

Our mental model this week is a type of a Network Effect that explains hows things spread: from a disease in a population to a wildfire in a forest to a meme on social media. Called Simple Diffusion, it is the way things move somewhat chaotically across a network. While a little long and slightly technical, I would urge you to slowly consume this article and play around with the interactive charts. It will be well worth your time.

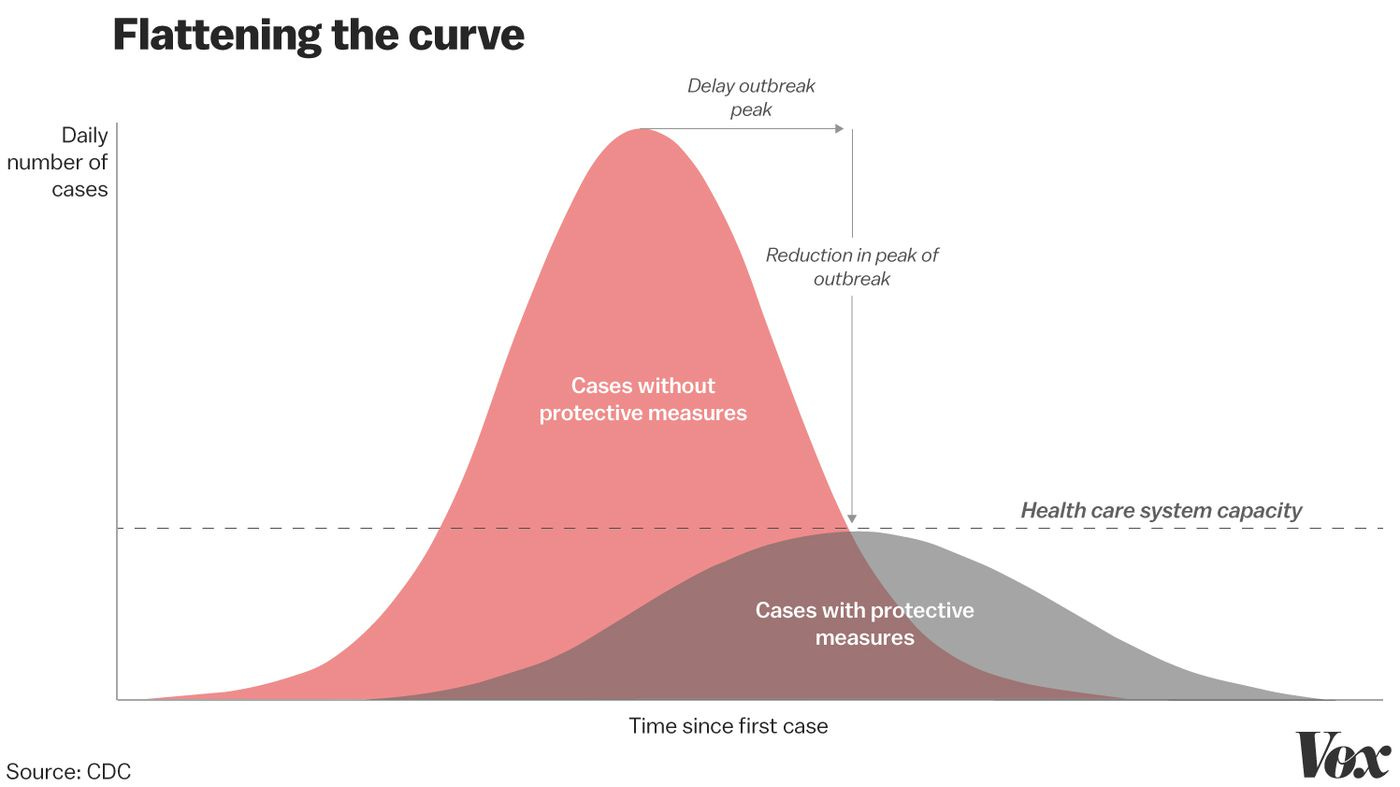

Understanding the above article will help you appreciate the following chart:

How canceled events and self-quarantines save lives.

Section 3: Lessons From History

If last week's market movements caused you to panic or worry, then this article is for you. The author looks back at previous market panics and draws important lessons for investors. A breezy read.

In another article, the above author looks at the panic of 1907 and its repercussions for investors and regulators. The author also draws some lessons for investors. Another breezy read - a perfect companion for your cup of coffee.

Section 4: Personal Development

Are you over-worked and sometimes out of control? Do you feel burdened by the cacophony of incoming emails, never-ending meeting requests and an ever-growing task list? Or are you simply looking for a system to boost your performance and productivity? This 5-minute video will get you going. It summarizes a popular time-management principle called Getting Things Done (GTD). Its basic premise is that most stress people experience comes from inappropriately managed commitments they make or accept. The principle lists down a few easy steps to free yourself from the endless loop of unfinished tasks.

"Needless commitments are more wasteful than needless possessions. Possessions can be ignored, but commitments are a recurring debt that must be paid for with your time and attention."

Section 5: Trivia

An interesting account of how large American Banks and the Federal Reserve came in being:

At the turn of the 20th century, there were over 15,000 banks in the US. These were divided into three main classes - country banks (smallest, rural), city banks (larger, metropolitan), and reserve banks (few large banks in cities like New York, Chicago, and St. Louis).

Each bank had its own reserves and lending system. When things got panicky, the banks would stop lending and hoard cash, leading to a complete drying up of the credit markets.

Each bank used to issue their own currency which was backed by their gold reserves, leading to different values of notes of each bank based on their credit strength.

Both the above led to extended period of deflation (due to hoarding of cash and unavailability of credit) - during a brutal 3 decade period from 1867 to 1897, prices for consumer goods fell by a whopping 50%.

A non-existent secondary market meant that banks had large amount of capital tied up in loans that they couldn't liquidate.

Banks had to keep a certain amount of its capital as reserves to be deposited with other banks (for example, country banks were required to deposit 25% of its capital in city banks, which were required to deposit 25% of its capital with reserve banks). Thus if a problem cropped up with a rural bank, it would quickly spread to cities and then the economy as a whole - creating a sort of a contagion.

Also, because there was no central bank that could inject capital into the system when fear was soaking it up, the banking system suffered from routine and frequent panics—the classic “run on the banks”.

The Panic of 1907 was started by one of these runs. Basically, the failure of a single small bank led to a widespread crisis where everyone feared that their deposits weren’t safe. People started hoarding cash, Banks also did.

This drained the reserves from the entire banking system, which seized up commerce. This led to a significant economic downturn and the eventual creation of large American Banks and the Federal Reserve Act.

Before I sign-off, I want to share a quote that captures the essence of this bulletin:

“Your actions are a consequence of your thoughts.

Your thoughts are a consequence of what you consume.

And in the modern age, what you consume is largely a consequence of how you select and refine your social media feed.

Choose better inputs. Get better outputs.”

One way to choose better inputs is to subscribe to this bulletin. If you have received this as a forward, simply click here to subscribe.

Lastly, if you like the above quotes from Adam Grant, may I suggest that you subscribe to his wonderful newsletter 3-2-1 (3 short ideas, 2 quotes, and 1 question) here.

* * *

Have a wonderful weekend!!

- Tejas Gutka.